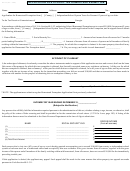

Please answer the following questions.

Yes

No

1. I own the agricultural property listed.

2. I am a Minnesota resident.

3. I do not claim another agricultural homestead in Minnesota and neither does my spouse.

4. I live within four townships or cities from the agricultural property listed.

If you answered NO to question #4 and you or your spouse are actively farming the property but are required to live in employer-

provided housing, which is more than four townships or cities away from the property, then you may still be eligible. You must

provide an affidavit and proof from the employer indicating that such a housing arrangement is a requirement of employment.

Please enter the following information for the agricultural property that you own and for which you are requesting a

Special Agricultural Homestead.

Parcel Identification Number

Number

List all uses of land

County

Enrolled in CRP,

(located on tax statement)

of Acres

Located

CREP or RIM*?

(indicate which one

and number of acres)

List any additional parcels on a separate piece of paper and attach it to this application.

I certify that I own the property listed and all the information is correct.

Signature

Date

Signature of Spouse

Date

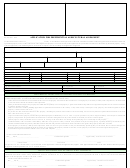

Instructions

Filing Requirements

Making False Statements

attorney verifying that you have filed a

form can be substituted for the form.

• If the property is owned by an authorized

on this Application is

• If there is new or additional agricultural

entity (family farm corporation, joint

Against the Law

property that the entity owns and for

family farm venture, family farm limited

which a Special Agricultural Homestead

Anyone giving false information in order

liability company, or a partnership which

to avoid or reduce their tax obligations

is requested, then the form “Applica-

is operating a family farm), then fill out

tion for Special Agricultural Homestead

is subject to a fine of up to $3,000 and/

the “Application for Special Agricultural

or up to one year in prison. (Minnesota

– Property Owned by an Authorized

Homestead – Property Owned by an

Statutes 609.41) The property owner may

Entity” must be completed.

Authorized Entity” and not this form.

be required to pay all tax that is due on

• The person actively farming the property

If Ownership, Occupancy,

the property based on its correct property

must fill out and sign.

or Active Farmer Status

class, plus a penalty equal to the same

• The owner of the property must fill out

amount. (Minnesota Statutes 273.124,

and sign the application. If the owner of

Changes

subdivision 13)

the property is also the person actively

If this property is sold, or if occupancy

farming it, then they must fill out all sec-

Use of Information

or active farmer status changes, or if

tions and sign both sides of the applica-

you change your marital status, state law

The information on this form is required

tion.

requires you to notify the County Asses-

by Minnesota Statutes, section 273.124 to

• This form must be completed, signed

sor within 30 days. If you fail to notify the

properly identify you and determine if you

and filed by December 15 of the current

County Assessor within 30 days, the proper-

qualify for this property tax classification.

assessment year with each county in

ty can be assessed the tax that is due on the

Your Social Security number is required.

which a Special Agricultural Homestead

property based on its correct property class

If you do not provide the required infor-

classification is requested. You must apply

plus a penalty equal to the same amount.

mation, your application may be delayed

every year for this classification.

or denied. Your County Assessor may also

• Attach a copy of your Federal 156 EZ

ask for additional verification of qualifi-

form from the FSA to this application.

cations. Your Social Security number is

An affidavit from your tax preparer or

considered private data.

* CRP = Conservation Reserve Program

CREP = Conservation Reserve Enhancement Program

RIM = Reinvest in Minnesota

Please return completed form to: Todd County Assessor's Office 215 1st Ave S, Suite #202 Long Prairie, MN 56347

320-732-4431

1

1 2

2