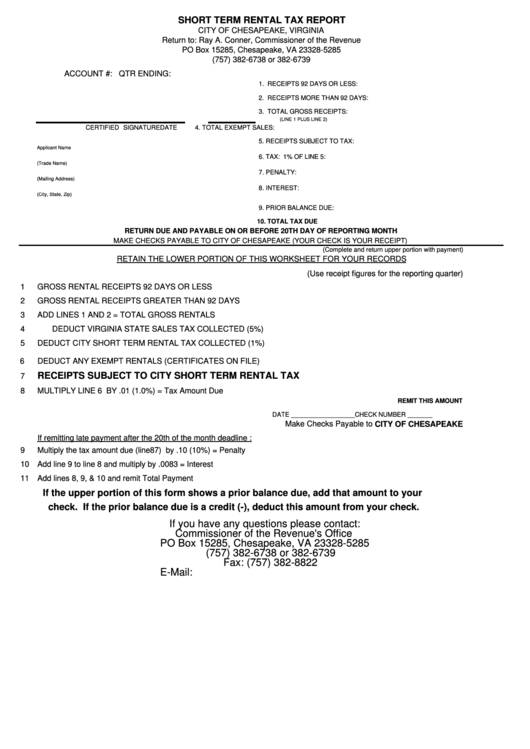

SHORT TERM RENTAL TAX REPORT

CITY OF CHESAPEAKE, VIRGINIA

Return to: Ray A. Conner, Commissioner of the Revenue

PO Box 15285, Chesapeake, VA 23328-5285

(757) 382-6738 or 382-6739

ACCOUNT #:

QTR ENDING:

1. RECEIPTS 92 DAYS OR LESS:

2. RECEIPTS MORE THAN 92 DAYS:

3. TOTAL GROSS RECEIPTS:

(LINE 1 PLUS LINE 2)

CERTIFIED SIGNATURE

DATE

4. TOTAL EXEMPT SALES:

5. RECEIPTS SUBJECT TO TAX:

Applicant Name

6. TAX: 1% OF LINE 5:

(Trade Name)

7. PENALTY:

(Mailing Address)

8. INTEREST:

(City, State, Zip)

9. PRIOR BALANCE DUE:

10. TOTAL TAX DUE

RETURN DUE AND PAYABLE ON OR BEFORE 20TH DAY OF REPORTING MONTH

MAKE CHECKS PAYABLE TO CITY OF CHESAPEAKE (YOUR CHECK IS YOUR RECEIPT)

(Complete and return upper portion with payment)

RETAIN THE LOWER PORTION OF THIS WORKSHEET FOR YOUR RECORDS

(Use receipt figures for the reporting quarter)

1

GROSS RENTAL RECEIPTS 92 DAYS OR LESS

2

GROSS RENTAL RECEIPTS GREATER THAN 92 DAYS

3

ADD LINES 1 AND 2 = TOTAL GROSS RENTALS

4

DEDUCT VIRGINIA STATE SALES TAX COLLECTED (5%)

5

DEDUCT CITY SHORT TERM RENTAL TAX COLLECTED (1%)

6

DEDUCT ANY EXEMPT RENTALS (CERTIFICATES ON FILE)

RECEIPTS SUBJECT TO CITY SHORT TERM RENTAL TAX

7

8

MULTIPLY LINE 6 BY .01 (1.0%) = Tax Amount Due

REMIT THIS AMOUNT

DATE __________________

CHECK NUMBER _______

Make Checks Payable to CITY OF CHESAPEAKE

If remitting late payment after the 20th of the month deadline :

9

Multiply the tax amount due (line87) by .10 (10%) = Penalty

10 Add line 9 to line 8 and multiply by .0083 = Interest

11 Add lines 8, 9, & 10 and remit Total Payment

If the upper portion of this form shows a prior balance due, add that amount to your

check. If the prior balance due is a credit (-), deduct this amount from your check.

If you have any questions please contact:

Commissioner of the Revenue's Office

PO Box 15285, Chesapeake, VA 23328-5285

(757) 382-6738 or 382-6739

Fax: (757) 382-8822

E-Mail: bustax@comrev.city.chesapeake.va.us

1

1