Sales And Use Tax Monthly Return - City Of King Cove

ADVERTISEMENT

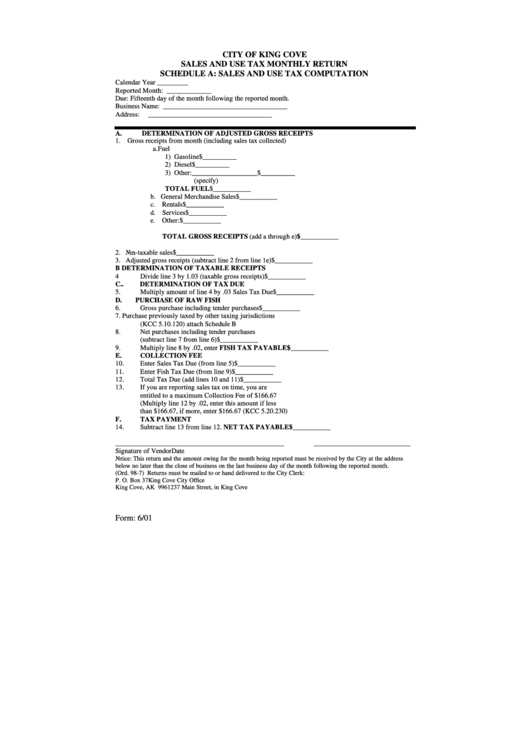

CITY OF KING COVE

SALES AND USE TAX MONTHLY RETURN

SCHEDULE A: SALES AND USE TAX COMPUTATION

Calendar Year _________

Reported Month: _____________

Due: Fifteenth day of the month following the reported month.

Business Name: ____________________________________

Address:

____________________________________

A.

DETERMINATION OF ADJUSTED GROSS RECEIPTS

1. Gross receipts from month (including sales tax collected)

a.

Fuel

1) Gasoline

$__________

2) Diesel

$__________

3) Other:___________________

$__________

(specify)

TOTAL FUEL

$___________

b. General Merchandise Sales

$___________

c. Rentals

$___________

d. Services

$___________

e. Other:

$___________

TOTAL GROSS RECEIPTS (add a through e)

$___________

2.

Non-taxable sales

$___________

3.

Adjusted gross receipts (subtract line 2 from line 1e)

$___________

B

DETERMINATION OF TAXABLE RECEIPTS

4

Divide line 3 by 1.03 (taxable gross receipts)

$___________

C..

DETERMINATION OF TAX DUE

5.

Multiply amount of line 4 by .03 Sales Tax Due

$___________

D.

PURCHASE OF RAW FISH

6.

Gross purchase including tender purchases

$___________

7.

Purchase previously taxed by other taxing jurisdictions

(KCC 5.10.120) attach Schedule B

8.

Net purchases including tender purchases

(subtract line 7 from line 6)

$___________

9.

Multiply line 8 by .02, enter FISH TAX PAYABLE

$___________

E.

COLLECTION FEE

10.

Enter Sales Tax Due (from line 5)

$___________

11.

Enter Fish Tax Due (from line 9)

$___________

12.

Total Tax Due (add lines 10 and 11)

$___________

13.

If you are reporting sales tax on time, you are

entitled to a maximum Collection Fee of $166.67

(Multiply line 12 by .02, enter this amount if less

than $166.67, if more, enter $166.67 (KCC 5.20.230)

F.

TAX PAYMENT

14.

Subtract line 13 from line 12. NET TAX PAYABLE

$___________

_________________________________________________

____________________________

Signature of Vendor

Date

Notice: This return and the amount owing for the month being reported must be received by the City at the address

below no later than the close of business on the last business day of the month following the reported month.

(Ord. 98-7) Returns must be mailed to or hand delivered to the City Clerk:

P. O. Box 37

King Cove City Office

King Cove, AK 99612

37 Main Street, in King Cove

Form: 6/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3