Petition For Abatement Or Refund Of Taxes Form - Colorado

ADVERTISEMENT

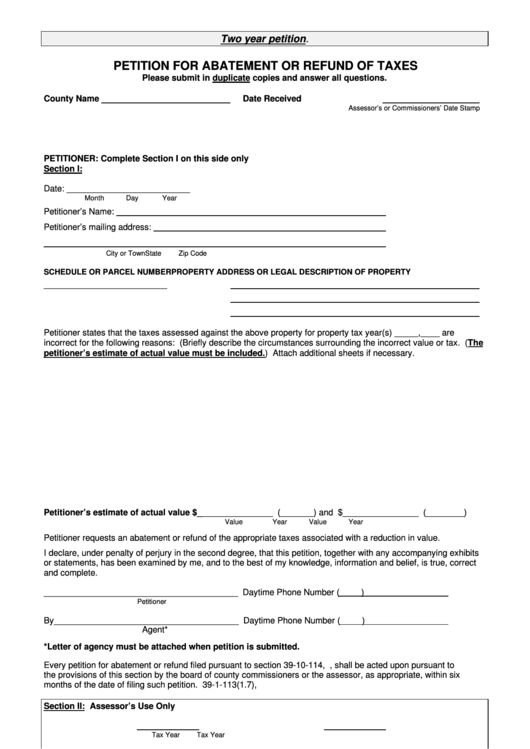

Two year petition.

PETITION FOR ABATEMENT OR REFUND OF TAXES

Please submit in duplicate copies and answer all questions.

County Name

Date Received

Assessor’s or Commissioners’ Date Stamp

PETITIONER: Complete Section I on this side only

Section I:

Date: __________________________

Month

Day

Year

Petitioner’s Name:

Petitioner’s mailing address:

City or Town

State

Zip Code

SCHEDULE OR PARCEL NUMBER

PROPERTY ADDRESS OR LEGAL DESCRIPTION OF PROPERTY

__________________________

Petitioner states that the taxes assessed against the above property for property tax year(s) _____,____ are

incorrect for the following reasons: (Briefly describe the circumstances surrounding the incorrect value or tax. (The

petitioner’s estimate of actual value must be included.) Attach additional sheets if necessary.

Petitioner’s estimate of actual value $________________ (_______) and $________________ (________)

Value

Year

Value

Year

Petitioner requests an abatement or refund of the appropriate taxes associated with a reduction in value.

I declare, under penalty of perjury in the second degree, that this petition, together with any accompanying exhibits

or statements, has been examined by me, and to the best of my knowledge, information and belief, is true, correct

and complete.

_________________________________________ Daytime Phone Number (

)

Petitioner

By_______________________________________ Daytime Phone Number (

)

Agent*

*Letter of agency must be attached when petition is submitted.

Every petition for abatement or refund filed pursuant to section 39-10-114, C.R.S., shall be acted upon pursuant to

the provisions of this section by the board of county commissioners or the assessor, as appropriate, within six

months of the date of filing such petition. 39-1-113(1.7), C.R.S.

Section II: Assessor’s Use Only

Tax Year

Tax Year

Assessed Value

Tax

Assessed Value

Tax

Original

____________

________

____________

__________

Corrected

Abate/Refund

____________

________

____________

__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2