Form F-Ss-4 - Income Tax Division Employer'S Withholding Registration

ADVERTISEMENT

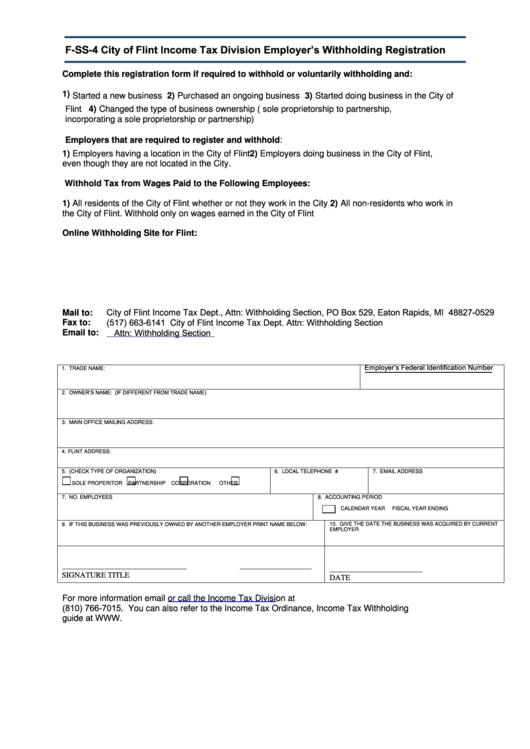

F-SS-4 City of Flint Income Tax Division Employer’s Withholding Registration

Complete this registration form if required to withhold or voluntarily withholding and:

1) Started a new business 2) Purchased an ongoing business 3) Started doing business in the City of

Flint 4) Changed the type of business ownership (e.g. from sole proprietorship to partnership,

incorporating a sole proprietorship or partnership)

Employers that are required to register and withhold:

1) Employers having a location in the City of Flint 2) Employers doing business in the City of Flint,

even though they are not located in the City.

Withhold Tax from Wages Paid to the Following Employees:

1) All residents of the City of Flint whether or not they work in the City 2) All non-residents who work in

the City of Flint. Withhold only on wages earned in the City of Flint

Online Withholding Site for Flint:

City of Flint Income Tax Dept., Attn: Withholding Section, PO Box 529, Eaton Rapids, MI 48827-0529

Mail to:

(517) 663-6141 City of Flint Income Tax Dept. Attn: Withholding Section

Fax to:

Attn: Withholding Section

Email to:

Employer’s Federal Identification Number

1. TRADE NAME:

2. OWNER’S NAME: (IF DIFFERENT FROM TRADE NAME)

3. MAIN OFFICE MAILING ADDRESS:

4. FLINT ADDRESS:

5. (CHECK TYPE OF ORGANIZATION)

6. LOCAL TELEPHONE #

7. EMAIL ADDRESS

SOLE PROPERITOR

PARTNERSHIP

CORPORATION

OTHER

7. NO. EMPLOYEES

8. ACCOUNTING PERIOD

CALENDAR YEAR

FISCAL YEAR ENDING

10. GIVE THE DATE THE BUSINESS WAS ACQUIRED BY CURRENT

9. IF THIS BUSINESS WAS PREVIOUSLY OWNED BY ANOTHER EMPLOYER PRINT NAME BELOW:

EMPLOYER

SIGNATURE

TITLE

DATE

For more information email

or call the Income Tax Division at

(810) 766-7015. You can also refer to the Income Tax Ordinance, Income Tax Withholding

guide at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1