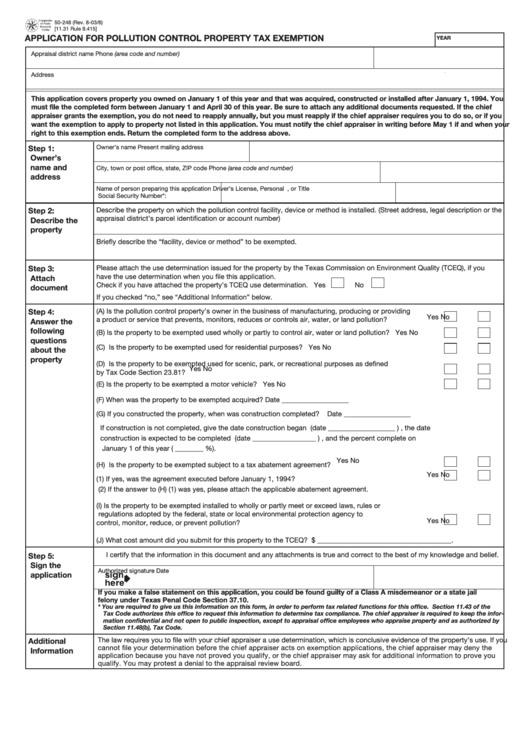

50-248 (Rev. 8-03/6)

[11.31 Rule 9.415]

APPLICATION FOR POLLUTION CONTROL PROPERTY TAX EXEMPTION

YEAR

Appraisal district name

Phone (area code and number)

Address

This application covers property you owned on January 1 of this year and that was acquired, constructed or installed after January 1, 1994. You

must file the completed form between January 1 and April 30 of this year. Be sure to attach any additional documents requested. If the chief

appraiser grants the exemption, you do not need to reapply annually, but you must reapply if the chief appraiser requires you to do so, or if you

want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing before May 1 if and when your

right to this exemption ends. Return the completed form to the address above.

Step 1:

Owner’s name

Present mailing address

Owner’s

name and

City, town or post office, state, ZIP code

Phone (area code and number)

address

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*:

Describe the property on which the pollution control facility, device or method is installed. (Street address, legal description or the

Step 2:

appraisal district’s parcel identification or account number)

Describe the

property

Briefly describe the “facility, device or method” to be exempted.

Step 3:

Please attach the use determination issued for the property by the Texas Commission on Environment Quality (TCEQ), if you

have the use determination when you file this application.

Attach

Check if you have attached the property’s TCEQ use determination. Yes

No

document

If you checked “no,” see “Additional Information” below.

Step 4:

(A) Is the pollution control property’s owner in the business of manufacturing, producing or providing

Yes

No

a product or service that prevents, monitors, reduces or controls air, water, or land pollution? .........

Answer the

following

(B) Is the property to be exempted used wholly or partly to control air, water or land pollution? ............... Yes

No

questions

(C) Is the property to be exempted used for residential purposes? ............................................................. Yes

No

about the

property

(D) Is the property to be exempted used for scenic, park, or recreational purposes as defined

Yes

No

by Tax Code Section 23.81? ...................................................................................................................

(E) Is the property to be exempted a motor vehicle? ................................................................................... Yes

No

(F) When was the property to be exempted acquired? Date ___________________

(G) If you constructed the property, when was construction completed?

Date ___________________

If construction is not completed, give the date construction began (date ___________________ ) , the date

construction is expected to be completed (date __________________ ) , and the percent complete on

January 1 of this year ( ________ %).

Yes

No

(H) Is the property to be exempted subject to a tax abatement agreement? .............................................

Yes

No

(1) If yes, was the agreement executed before January 1, 1994? ........................................................

(2) If the answer to (H) (1) was yes, please attach the applicable abatement agreement.

(I) Is the property to be exempted installed to wholly or partly meet or exceed laws, rules or

regulations adopted by the federal, state or local environmental protection agency to

Yes

No

control, monitor, reduce, or prevent pollution? ......................................................................................

(J) What cost amount did you submit for this property to the TCEQ? $ ______________________________________.

I certify that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Step 5:

Sign the

Authorized signature

Date

application

If you make a false statement on this application, you could be found guilty of a Class A misdemeanor or a state jail

felony under Texas Penal Code Section 37.10.

* You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the

Tax Code authorizes this office to request this information to determine tax compliance. The chief appraiser is required to keep the infor-

mation confidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized by

Section 11.48(b), Tax Code.

The law requires you to file with your chief appraiser a use determination, which is conclusive evidence of the property’s use. If you

Additional

cannot file your determination before the chief appraiser acts on exemption applications, the chief appraiser may deny the

Information

application because you have not proved you qualify, or the chief appraiser may ask for additional information to prove you

qualify. You may protest a denial to the appraisal review board.

1

1