50-144-4 (Rev. 8-97/4)

[Ren. V-22.15]

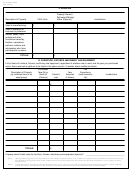

V. OTHER PERSONAL PROPERTY

List below any items of personal property owned by you which have not been listed in any other schedule in this return. If needed,

attach additional sheets.

Life

Market Value

Year

Expectancy

as of Jan. 1st

Owner's

Acquired

(total economic

Description of Property

(Optional)*

Cost

(if known)

life)

Jurisdictions

$

TOTALS

$

* NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the rendered value is to

be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal review board. (Tex. Property Tax Code

Section 25.19)

NOTE:

If inventory you own is subject to Tax Code Sections 23.121; 23.127; 23.1241; or 23.12D, an alternate method of appraising vehicles, vessels, outboard

motors and trailers, manufactured housing, and heavy equipment is required and you need not list that inventory on this rendition.

I affirm that the information contained in this report is accurate and complete to the best of my knowledge and belief and that

complete information necessary to identify the property and to determine its ownership, taxability and situs will be made available for

inspection to employees of the appraisal district on request.

Company name

Title

Are you the property owner, an employee of the property owner, or acting on behalf of an affiliated entity of the property owner?

Yes

No

The application must be signed and dated. By signing this document, you attest that the information contained on it is true and

correct to the best of your knowledge and belief. If you checked “Yes” above, sign and date the application.

sign

Signature

here

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and accurate.

sign

Signature

here

__________________________________________________________________ Date _________________

I attest that the individual signing above subscribed and swore to the accuracy and truth of the information provided on this form

before me, this the ______ day of ________________ , ______ .

_________________________________________

Notary Public

Section 22.26 of the Property Tax Code states:

(a) Each rendition statement or property report required or authorized by this chapter must be signed by an

individual who is required to file the statement or report.

(b) When a corporation is required to file a statement or report, an officer of the corporation or an employee or

agent who has been designated in writing by the board of directors or by an authorized officer to sign in behalf

of the corporation must sign the statement or report.

1

1 2

2 3

3 4

4