50-144-2 (Rev. 8-97/4)

[Ren. V-22.15]

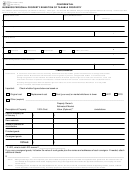

II. SUPPLIES

Property Owner's

Estimate of Market

Description of Property

100% Cost

Value (Optional)*

Jurisdictions

Used in manufacturing

$

$

Used in operation of

business or profession

Bottles, cases, cans,

jackets and other

containers owned by

bottlers, creameries,

packers, retailers and

wholesalers who have

paid deposits on same.

TOTALS

$

$

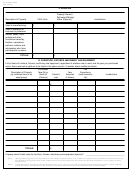

III. FURNITURE, FIXTURES, MACHINERY AND EQUIPMENT

List all items of furniture, fixtures, machinery and equipment, regardless of whether new or used, and the year you purchased

same. Items received as gifts are to be listed in the same manner. If needed, attach additional sheets.

Purchased

Life

Description of Property

New (N) or

Year

Expectancy

(by individual item or by

Used (U)

Owner's

Acquired

(total economic

Jurisdictions

asset group)

(if known)

cost

(if known)

life)

$

TOTALS

$

Property owner's total value for furniture, fixtures, machinery and equipment (optional)*: __________________________________

* NOTE:

Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the rendered value is to

be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal review board. (Tex. Property Tax Code

Section 25.19)

NOTE:

If inventory you own is subject to Tax Code Sections 23.121; 23.127; 23.1241; or 23.12D, an alternate method of appraising vehicles, vessels, outboard

motors and trailers, manufactured housing, and heavy equipment is required and you need not list that inventory on this rendition.

1

1 2

2 3

3 4

4