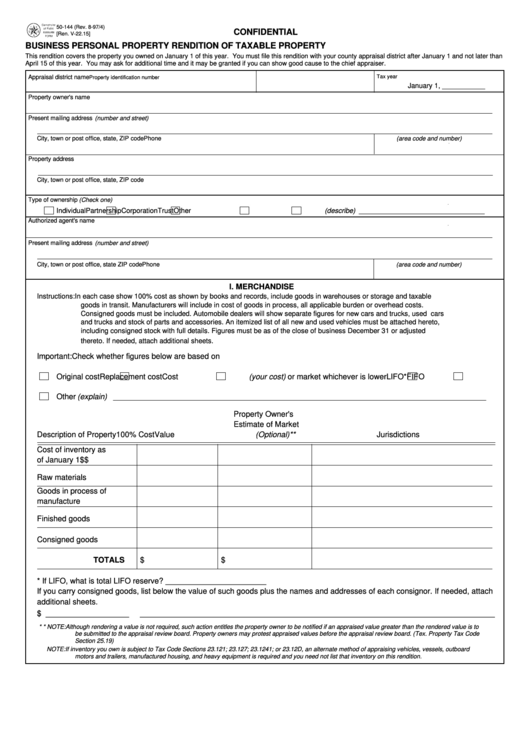

50-144 (Rev. 8-97/4)

CONFIDENTIAL

[Ren. V-22.15]

BUSINESS PERSONAL PROPERTY RENDITION OF TAXABLE PROPERTY

This rendition covers the property you owned on January 1 of this year. You must file this rendition with your county appraisal district after January 1 and not later than

April 15 of this year. You may ask for additional time and it may be granted if you can show good cause to the chief appraiser.

Appraisal district name

Tax year

Property identification number

January 1, ___________

Property owner's name

Present mailing address (number and street)

City, town or post office, state, ZIP code

Phone (area code and number)

Property address

City, town or post office, state, ZIP code

Type of ownership (Check one)

Individual

Partnership

Corporation

Trust

Other (describe) ________________________________

Authorized agent's name

Present mailing address (number and street)

Phone (area code and number)

City, town or post office, state ZIP code

I. MERCHANDISE

Instructions: In each case show 100% cost as shown by books and records, include goods in warehouses or storage and taxable

goods in transit. Manufacturers will include in cost of goods in process, all applicable burden or overhead costs.

Consigned goods must be included. Automobile dealers will show separate figures for new cars and trucks, used cars

and trucks and stock of parts and accessories. An itemized list of all new and used vehicles must be attached hereto,

including consigned stock with full details. Figures must be as of the close of business December 31 or adjusted

thereto. If needed, attach additional sheets.

Important:

Check whether figures below are based on

Cost (your cost) or market whichever is lower

Original cost

Replacement cost

LIFO*

FIFO

Other (explain) _______________________________________________________________________________________

Property Owner's

Estimate of Market

Description of Property

100% Cost

Value (Optional)**

Jurisdictions

Cost of inventory as

of January 1

$

$

Raw materials

Goods in process of

manufacture

Finished goods

Consigned goods

TOTALS

$

$

* If LIFO, what is total LIFO reserve? _______________________

If you carry consigned goods, list below the value of such goods plus the names and addresses of each consignor. If needed, attach

additional sheets.

$ ___________________

_________________________________________________________________________________

* * NOTE: Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the rendered value is to

be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal review board. (Tex. Property Tax Code

Section 25.19)

NOTE:

If inventory you own is subject to Tax Code Sections 23.121; 23.127; 23.1241; or 23.12D, an alternate method of appraising vehicles, vessels, outboard

motors and trailers, manufactured housing, and heavy equipment is required and you need not list that inventory on this rendition.

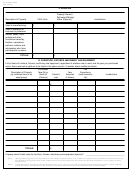

1

1 2

2 3

3 4

4