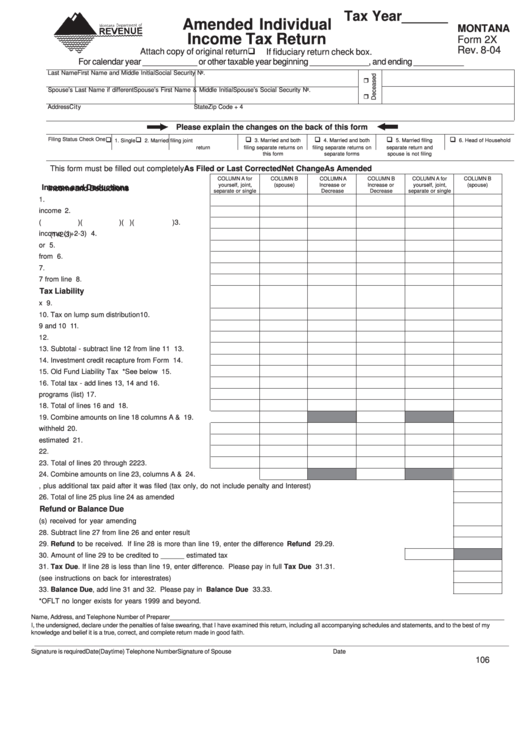

Tax Year______

Amended Individual

MONTANA

Income Tax Return

Form 2X

Rev. 8-04

Attach copy of original return

If fiduciary return check box.

For calendar year ____________ or other taxable year beginning _____________, and ending ___________

Last Name

First Name and Middle Initial

Social Security No.

Spouse’s Last Name if different

Spouse’s First Name & Middle Initial

Spouse’s Social Security No.

Address

City

State

Zip Code + 4

Please explain the changes on the back of this form

Filing Status Check One

1. Single

2. Married filing joint

3. Married and both

4. Married and both

5. Married filing

6. Head of Household

return

filing separate returns on

filing separate returns on

separate return and

this form

separate forms

spouse is not filing

This form must be filled out completely

As Filed or Last Corrected

Net Change

As Amended

COLUMN A for

COLUMN B

COLUMN A

COLUMN B

COLUMN A for

COLUMN B

yourself, joint,

(spouse)

Increase or

Increase or

yourself, joint,

(spouse)

Income and Deductions

Income and Deductions

separate or single

Decrease

Decrease

separate or single

1. Federal adjusted gross income ............................ 1.

1.

1. Federal adjusted gross income................................1.

2. Additions to income ............................................... 2.

2.

2. Additions to income...................................................2.

3. Reduction of income ............................................. 3. (

) (

)

(

) (

) 3.

3. Reduction of income..................................................3.

4. Montana adjusted gross income (1+2-3) ............. 4.

4.

4. Montana adjusted gross income (1+2-3).................4.

5. Deductions - itemized or standard ........................ 5.

5.

5. Deductions - itemized or standard............................5.

6. Subtract line 5 from 4 ............................................ 6.

6.

6. Subtract line 5 from 4.................................................6.

7. Enter exemption deduction .................................... 7.

7.

7. Enter exemption deduction........................................7.

8. Taxable income - subtract line 7 from line 6 ......... 8.

8.

8. Taxable income - subtract line 7 from line 6.............8.

Tax Liability

9. Tax liability from tax table ...................................... 9.

9.

10. Tax on lump sum distribution ............................... 10.

10.

11. Subtotal - add lines 9 and 10 .............................. 11.

11.

12. Allowable credits ................................................ 12.

12.

13. Subtotal - subtract line 12 from line 11 ............... 13.

13.

14. Investment credit recapture from Form RIC ........ 14.

14.

15. Old Fund Liability Tax *See below ..................... 15.

15.

16. Total tax - add lines 13, 14 and 15 ...................... 16.

16.

17. Contributions to other programs (list) ................. 17.

17.

18. Total of lines 16 and 17 ....................................... 18.

18.

19. Combine amounts on line 18 columns A & B ................................ 19.

19.

20. Montana tax withheld .......................................... 20.

20.

21. Payments and credits on estimated tax ............. 21.

21.

22. Elderly Homeowner/Renter Credit from Form 2EC ... 22.

22.

23. Total of lines 20 through 22 ................................ 23.

23.

24. Combine amounts on line 23, columns A & B ............................... 24.

24.

25. Amount paid with original return, plus additional tax paid after it was filed (tax only, do not include penalty and Interest) .......... 25.

25.

26. Total of line 25 plus line 24 as amended ............................................................................................................................................ 26.

26.

Refund or Balance Due

27. Total refund(s) received for year amending ..................................................................................................................................... 27.

27.

28. Subtract line 27 from line 26 and enter result ................................................................................................................................... 28.

28.

29. Refund to be received. If line 28 is more than line 19, enter the difference ................................................................... Refund 29.

29.

30. Amount of line 29 to be credited to ______ estimated tax ..................................................................................... 30.

30.

31. Tax Due. If line 28 is less than line 19, enter difference. Please pay in full .................................................................. Tax Due 31.

31.

32. Interest computed on amount shown on line 31 (see instructions on back for interest rates) ...................................................... 32.

32.

33. Balance Due, add line 31 and 32. Please pay in full .............................................................................................. Balance Due 33.

33.

*OFLT no longer exists for years 1999 and beyond.

Name, Address, and Telephone Number of Preparer __________________________________________________________________________________________________

I, the undersigned, declare under the penalties of false swearing, that I have examined this return, including all accompanying schedules and statements, and to the best of my

knowledge and belief it is a true, correct, and complete return made in good faith.

___________________________________________________________________________________________________________________________________________

Signature is required

Date

(Daytime) Telephone Number

Signature of Spouse

Date

106

1

1 2

2