Form 106-Ep - Colorado Composite Nonresident Return Estimated Tax Payment Voucher - 2000

ADVERTISEMENT

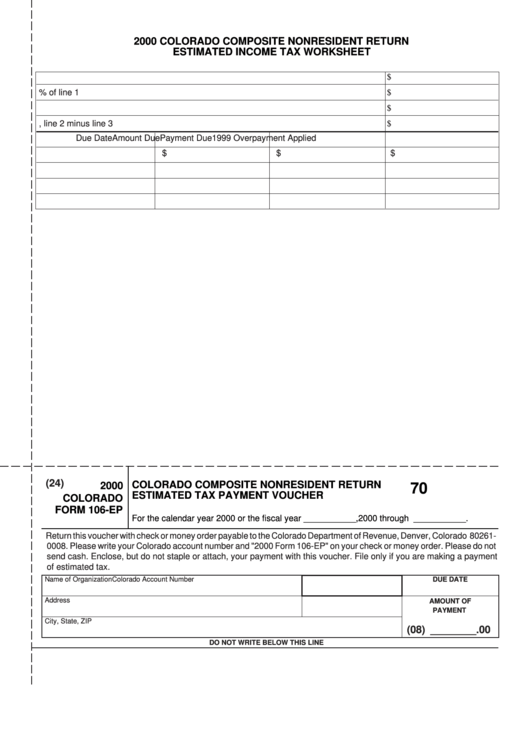

2000 COLORADO COMPOSITE NONRESIDENT RETURN

ESTIMATED INCOME TAX WORKSHEET

1.

Estimated 2000 Colorado taxable income

$

2.

Estimated 2000 Colorado income tax - 4.75% of line 1

$

3.

Estimated 2000 Form 106CR credits

$

4.

Net estimated tax, line 2 minus line 3

$

Due Date

Amount Due

1999 Overpayment Applied

Payment Due

$

$

$

(24)

COLORADO COMPOSITE NONRESIDENT RETURN

2000

70

ESTIMATED TAX PAYMENT VOUCHER

COLORADO

FORM 106-EP

For the calendar year 2000 or the fiscal year ___________,2000 through ___________.

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-

0008. Please write your Colorado account number and "2000 Form 106-EP" on your check or money order. Please do not

send cash. Enclose, but do not staple or attach, your payment with this voucher. File only if you are making a payment

of estimated tax.

Name of Organization

Colorado Account Number

DUE DATE

Address

F.E.I.N.

AMOUNT OF

PAYMENT

City, State, ZIP

(08) ________ .00

DO NOT WRITE BELOW THIS LINE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2