Form 21943 - Audit Billback Form

Download a blank fillable Form 21943 - Audit Billback Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 21943 - Audit Billback Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

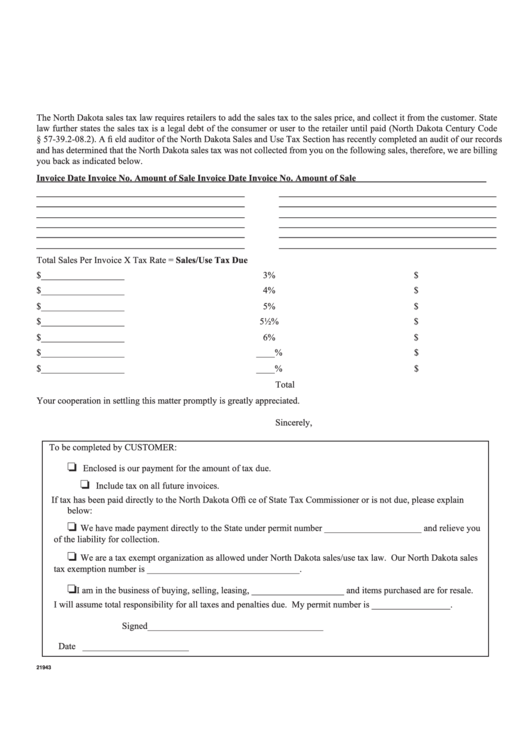

The North Dakota sales tax law requires retailers to add the sales tax to the sales price, and collect it from the customer. State

law further states the sales tax is a legal debt of the consumer or user to the retailer until paid (North Dakota Century Code

§ 57-39.2-08.2). A fi eld auditor of the North Dakota Sales and Use Tax Section has recently completed an audit of our records

and has determined that the North Dakota sales tax was not collected from you on the following sales, therefore, we are billing

you back as indicated below.

Invoice Date

Invoice No.

Amount of Sale

Invoice Date

Invoice No.

Amount of Sale

_____________________________________________

_______________________________________________

_____________________________________________

_______________________________________________

_____________________________________________

_______________________________________________

_____________________________________________

_______________________________________________

_____________________________________________

_______________________________________________

_____________________________________________

_______________________________________________

Total Sales Per Invoice

X

Tax Rate

=

Sales/Use Tax Due

$__________________

3%

$ __________________

$__________________

4%

$ __________________

$__________________

5%

$ __________________

$__________________

5½%

$ __________________

$__________________

6%

$ __________________

$__________________

____%

$ __________________

$__________________

____%

$ __________________

Total Due

$ __________________

Your cooperation in settling this matter promptly is greatly appreciated.

Sincerely,

To be completed by CUSTOMER:

❏

Enclosed is our payment for the amount of tax due.

❏

Include tax on all future invoices.

If tax has been paid directly to the North Dakota Offi ce of State Tax Commissioner or is not due, please explain

below:

❏

We have made payment directly to the State under permit number _____________________ and relieve you

of the liability for collection.

❏

We are a tax exempt organization as allowed under North Dakota sales/use tax law. Our North Dakota sales

tax exemption number is _________________________________.

❏

I am in the business of buying, selling, leasing, ____________________ and items purchased are for resale.

I will assume total responsibility for all taxes and penalties due. My permit number is _________________.

Signed______________________________________

Date _______________________

21943

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1