Form O-Mf3 - State Of Connecticut - Department Of Revenue Services

ADVERTISEMENT

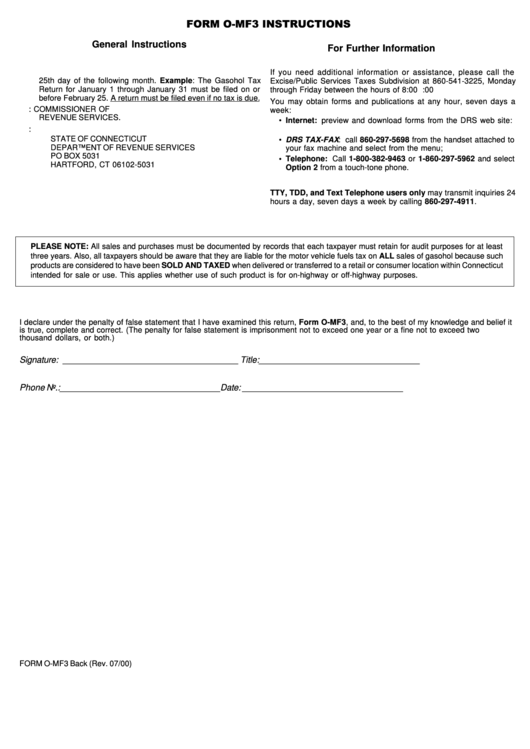

FORM O-MF3 INSTRUCTIONS

General Instructions

For Further Information

1. Taxpayers must file a return for each calendar month by the

If you need additional information or assistance, please call the

25th day of the following month. Example: The Gasohol Tax

Excise/Public Services Taxes Subdivision at 860-541-3225, Monday

Return for January 1 through January 31 must be filed on or

through Friday between the hours of 8:00 a.m. and 5:00 p.m.

before February 25. A return must be filed even if no tax is due.

You may obtain forms and publications at any hour, seven days a

2. Make check or money order payable to: COMMISSIONER OF

week:

REVENUE SERVICES.

• Internet: preview and download forms from the DRS web site:

3. Mail to:

STATE OF CONNECTICUT

• DRS TAX-FAX : call 860-297-5698 from the handset attached to

DEPARTMENT OF REVENUE SERVICES

your fax machine and select from the menu;

PO BOX 5031

• Telephone: Call 1-800-382-9463 or 1-860-297-5962 and select

HARTFORD, CT 06102-5031

Option 2 from a touch-tone phone.

TTY, TDD, and Text Telephone users only may transmit inquiries 24

hours a day, seven days a week by calling 860-297-4911.

PLEASE NOTE: All sales and purchases must be documented by records that each taxpayer must retain for audit purposes for at least

three years. Also, all taxpayers should be aware that they are liable for the motor vehicle fuels tax on ALL sales of gasohol because such

products are considered to have been SOLD AND TAXED when delivered or transferred to a retail or consumer location within Connecticut

intended for sale or use. This applies whether use of such product is for on-highway or off-highway purposes.

I declare under the penalty of false statement that I have examined this return, Form O-MF3, and, to the best of my knowledge and belief it

is true, complete and correct. (The penalty for false statement is imprisonment not to exceed one year or a fine not to exceed two

thousand dollars, or both.)

Signature: ____________________________________ Title: _________________________________

Phone No.:

_________________________________ Date: _________________________________

FORM O-MF3 Back (Rev. 07/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1