Form Changes - Summary Of Changes & Common Problem Areas/general Instructions For Filing Business Taxes/etc.

ADVERTISEMENT

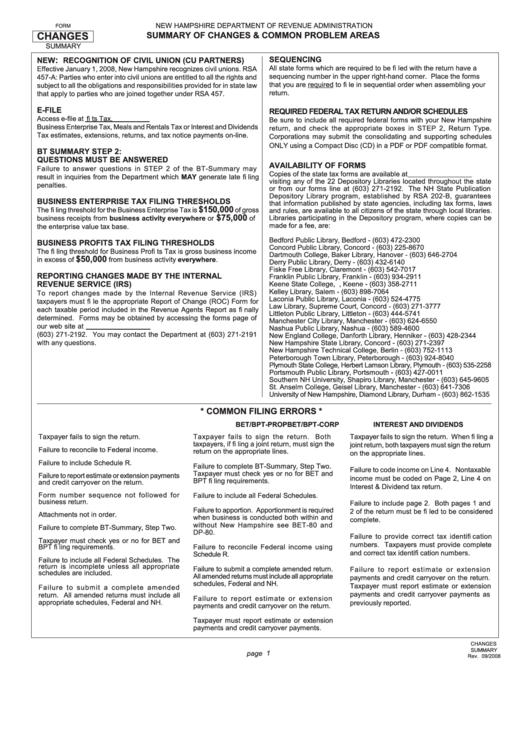

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

CHANGES

SUMMARY OF CHANGES & COMMON PROBLEM AREAS

SUMMARY

:

SEQUENCING

NEW

RECOGNITION OF CIVIL UNION (CU PARTNERS)

All state forms which are required to be fi led with the return have a

Effective January 1, 2008, New Hampshire recognizes civil unions. RSA

sequencing number in the upper right-hand corner. Place the forms

457-A: Parties who enter into civil unions are entitled to all the rights and

that you are required to fi le in sequential order when assembling your

subject to all the obligations and responsibilities provided for in state law

return.

that apply to parties who are joined together under RSA 457.

E-FILE

REQUIRED FEDERAL TAX RETURN AND/OR SCHEDULES

Access e-fi le at to make your Business Profi ts Tax,

Be sure to include all required federal forms with your New Hampshire

Business Enterprise Tax, Meals and Rentals Tax or Interest and Dividends

return, and check the appropriate boxes in STEP 2, Return Type.

Tax estimates, extensions, returns, and tax notice payments on-line.

Corporations may submit the consolidating and supporting schedules

ONLY using a Compact Disc (CD) in a PDF or PDF compatible format.

BT SUMMARY STEP 2:

QUESTIONS MUST BE ANSWERED

AVAILABILITY OF FORMS

Failure to answer questions in STEP 2 of the BT-Summary may

Copies of the state tax forms are available at or by

result in inquiries from the Department which MAY generate late fi ling

visiting any of the 22 Depository Libraries located throughout the state

penalties.

or from our forms line at (603) 271-2192. The NH State Publication

Depository Library program, established by RSA 202-B, guarantees

BUSINESS ENTERPRISE TAX FILING THRESHOLDS

that information published by state agencies, including tax forms, laws

$150,000

The fi ling threshold for the Business Enterprise Tax is

of gross

and rules, are available to all citizens of the state through local libraries.

$75,000

business receipts from business activity everywhere or

of

Libraries participating in the Depository program, where copies can be

made for a fee, are:

the enterprise value tax base.

Bedford Public Library, Bedford - (603) 472-2300

BUSINESS PROFITS TAX FILING THRESHOLDS

Concord Public Library, Concord - (603) 225-8670

The fi ling threshold for Business Profi ts Tax is gross business income

Dartmouth College, Baker Library, Hanover - (603) 646-2704

$50,000

in excess of

from business activity everywhere.

Derry Public Library, Derry - (603) 432-6140

Fiske Free Library, Claremont - (603) 542-7017

REPORTING CHANGES MADE BY THE INTERNAL

Franklin Public Library, Franklin - (603) 934-2911

REVENUE SERVICE (IRS)

Keene State College, W.E. Mason Library, Keene - (603) 358-2711

Kelley Library, Salem - (603) 898-7064

To report changes made by the Internal Revenue Service (IRS)

Laconia Public Library, Laconia - (603) 524-4775

taxpayers must fi le the appropriate Report of Change (ROC) Form for

Law Library, Supreme Court, Concord - (603) 271-3777

each taxable period included in the Revenue Agents Report as fi nally

Littleton Public Library, Littleton - (603) 444-5741

determined. Forms may be obtained by accessing the forms page of

Manchester City Library, Manchester - (603) 624-6550

our web site at or by contacting the forms line at

Nashua Public Library, Nashua - (603) 589-4600

(603) 271-2192. You may contact the Department at (603) 271-2191

New England College, Danforth Library, Henniker - (603) 428-2344

with any questions.

New Hampshire State Library, Concord - (603) 271-2397

New Hampshire Technical College, Berlin - (603) 752-1113

Peterborough Town Library, Peterborough - (603) 924-8040

Plymouth State College, Herbert Lamson Library, Plymouth - (603) 535-2258

Portsmouth Public Library, Portsmouth - (603) 427-0011

Southern NH University, Shapiro Library, Manchester - (603) 645-9605

St. Anselm College, Geisel Library, Manchester - (603) 641-7306

University of New Hampshire, Diamond Library, Durham - (603) 862-1535

* COMMON FILING ERRORS *

BET/BPT-CORP

BET/BPT-PROP

INTEREST AND DIVIDENDS

Taxpayer fails to sign the return.

Taxpayer fails to sign the return. Both

Taxpayer fails to sign the return. When fi ling a

taxpayers, if fi ling a joint return, must sign the

joint return, both taxpayers must sign the return

Failure to reconcile to Federal income.

return on the appropriate lines.

on the appropriate lines.

Failure to include Schedule R.

Failure to complete BT-Summary, Step Two.

Failure to code income on Line 4. Nontaxable

Taxpayer must check yes or no for BET and

Failure to report estimate or extension payments

income must be coded on Page 2, Line 4 on

BPT fi ling requirements.

and credit carryover on the return.

Interest & Dividend tax return.

Form number sequence not followed for

Failure to include all Federal Schedules.

business return.

Failure to include page 2. Both pages 1 and

Failure to apportion. Apportionment is required

2 of the return must be fi led to be considered

Attachments not in order.

when business is conducted both within and

complete.

without New Hampshire see BET-80 and

Failure to complete BT-Summary, Step Two.

DP-80.

Failure to provide correct tax identifi cation

Taxpayer must check yes or no for BET and

numbers. Taxpayers must provide complete

BPT fi ling requirements.

Failure to reconcile Federal income using

and correct tax identifi cation numbers.

Schedule R.

Failure to include all Federal Schedules. The

return is incomplete unless all appropriate

Failure to submit a complete amended return.

Failure to report estimate or extension

schedules are included.

All amended returns must include all appropriate

payments and credit carryover on the return.

schedules, Federal and NH.

Taxpayer must report estimate or extension

Failure to submit a complete amended

payments and credit carryover payments as

return. All amended returns must include all

Failure to report estimate or extension

appropriate schedules, Federal and NH.

previously reported.

payments and credit carryover on the return.

Taxpayer must report estimate or extension

payments and credit carryover payments.

CHANGES

SUMMARY

page

1

Rev. 09/2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5