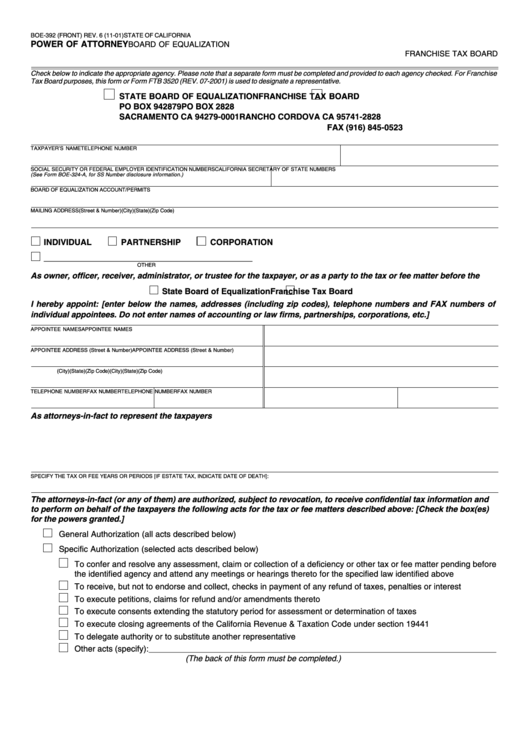

BOE-392 (FRONT) REV. 6 (11-01)

STATE OF CALIFORNIA

POWER OF ATTORNEY

BOARD OF EQUALIZATION

FRANCHISE TAX BOARD

Check below to indicate the appropriate agency. Please note that a separate form must be completed and provided to each agency checked. For Franchise

Tax Board purposes, this form or Form FTB 3520 (REV. 07-2001) is used to designate a representative.

STATE BOARD OF EQUALIZATION

FRANCHISE TAX BOARD

PO BOX 942879

PO BOX 2828

SACRAMENTO CA 94279-0001

RANCHO CORDOVA CA 95741-2828

FAX (916) 845-0523

TAXPAYER’S NAME

TELEPHONE NUMBER

SOCIAL SECURITY OR FEDERAL EMPLOYER IDENTIFICATION NUMBERS

CALIFORNIA SECRETARY OF STATE NUMBERS

(See Form BOE-324-A, for SS Number disclosure information.)

BOARD OF EQUALIZATION ACCOUNT/PERMITS

MAILING ADDRESS

(Street & Number)

(City)

(State)

(Zip Code)

INDIVIDUAL

PARTNERSHIP

CORPORATION

_____________________________________________

OTHER

As owner, officer, receiver, administrator, or trustee for the taxpayer, or as a party to the tax or fee matter before the

State Board of Equalization

Franchise Tax Board

I hereby appoint: [enter below the names, addresses (including zip codes), telephone numbers and FAX numbers of

individual appointees. Do not enter names of accounting or law firms, partnerships, corporations, etc.]

APPOINTEE NAMES

APPOINTEE NAMES

APPOINTEE ADDRESS (Street & Number)

APPOINTEE ADDRESS (Street & Number)

(City)

(State)

(Zip Code)

(City)

(State)

(Zip Code)

TELEPHONE NUMBER

FAX NUMBER

TELEPHONE NUMBER

FAX NUMBER

As attorneys-in-fact to represent the taxpayers

SPECIFY THE TAX OR FEE YEARS OR PERIODS [IF ESTATE TAX, INDICATE DATE OF DEATH]:

The attorneys-in-fact (or any of them) are authorized, subject to revocation, to receive confidential tax information and

to perform on behalf of the taxpayers the following acts for the tax or fee matters described above: [Check the box(es)

for the powers granted.]

General Authorization (all acts described below)

Specific Authorization (selected acts described below)

To confer and resolve any assessment, claim or collection of a deficiency or other tax or fee matter pending before

the identified agency and attend any meetings or hearings thereto for the specified law identified above

To receive, but not to endorse and collect, checks in payment of any refund of taxes, penalties or interest

To execute petitions, claims for refund and/or amendments thereto

To execute consents extending the statutory period for assessment or determination of taxes

To execute closing agreements of the California Revenue & Taxation Code under section 19441

To delegate authority or to substitute another representative

Other acts (specify): ___________________________________________________________________________

(The back of this form must be completed.)

1

1 2

2