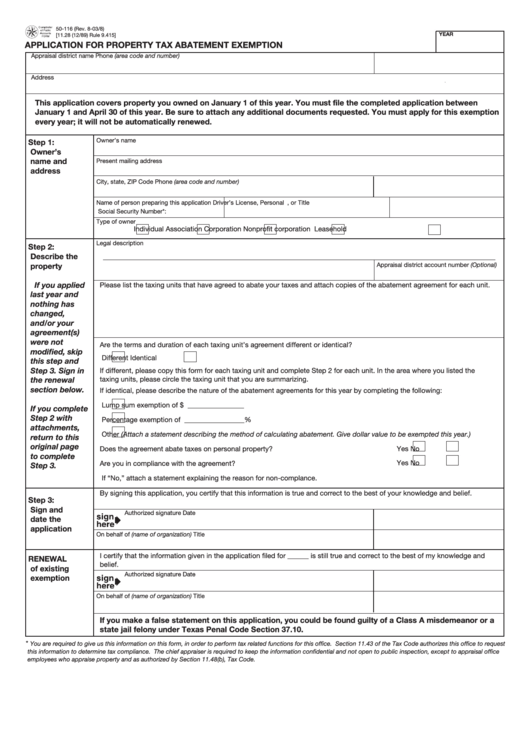

50-116 (Rev. 8-03/8)

YEAR

[11.28 (12/89) Rule 9.415]

APPLICATION FOR PROPERTY TAX ABATEMENT EXEMPTION

Appraisal district name

Phone (area code and number)

Address

This application covers property you owned on January 1 of this year. You must file the completed application between

January 1 and April 30 of this year. Be sure to attach any additional documents requested. You must apply for this exemption

every year; it will not be automatically renewed.

Owner’s name

Step 1:

Owner’s

name and

Present mailing address

address

City, state, ZIP Code

Phone (area code and number)

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*:

Type of owner

Individual

Association

Corporation

Nonprofit corporation

Leasehold

Legal description

Step 2:

Describe the

property

Appraisal district account number (Optional)

If you applied

Please list the taxing units that have agreed to abate your taxes and attach copies of the abatement agreement for each unit.

last year and

nothing has

changed,

and/or your

agreement(s)

were not

Are the terms and duration of each taxing unit’s agreement different or identical?

modified, skip

Different

Identical

this step and

Step 3. Sign in

If different, please copy this form for each taxing unit and complete Step 2 for each unit. In the area where you listed the

the renewal

taxing units, please circle the taxing unit that you are summarizing.

section below.

If identical, please describe the nature of the abatement agreements for this year by completing the following:

Lump sum exemption of $ ________________

If you complete

Step 2 with

Percentage exemption of _________________ %

attachments,

Other (Attach a statement describing the method of calculating abatement. Give dollar value to be exempted this year.)

return to this

original page

Yes

No

Does the agreement abate taxes on personal property? ..............................................

to complete

Yes

No

Are you in compliance with the agreement? .................................................................

Step 3.

If “No,” attach a statement explaining the reason for non-complance.

By signing this application, you certify that this information is true and correct to the best of your knowledge and belief.

Step 3:

Sign and

Authorized signature

Date

date the

application

On behalf of (name of organization)

Title

I certify that the information given in the application filed for ______ is still true and correct to the best of my knowledge and

RENEWAL

belief.

of existing

Authorized signature

Date

exemption

On behalf of (name of organization)

Title

If you make a false statement on this application, you could be found guilty of a Class A misdemeanor or a

state jail felony under Texas Penal Code Section 37.10.

*

You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax Code authorizes this office to request

this information to determine tax compliance. The chief appraiser is required to keep the information confidential and not open to public inspection, except to appraisal office

employees who appraise property and as authorized by Section 11.48(b), Tax Code.

1

1