Form Wv/mft-508 - A Importer Schedule Of Tax-Paid Receipts - 2007

ADVERTISEMENT

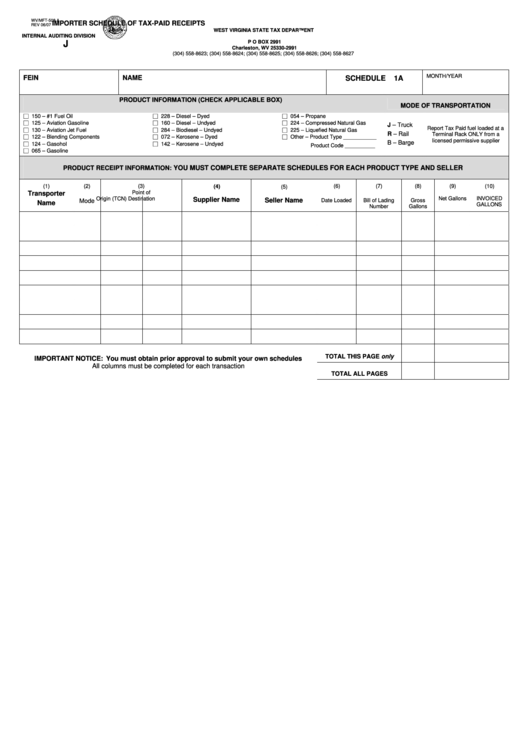

WV/MFT-508 A

IMPORTER SCHEDULE OF TAX-PAID RECEIPTS

REV 06/07

WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

P O BOX 2991

J

Charleston, WV 25330-2991

(304) 558-8623; (304) 558-8624; (304) 558-8625; (304) 558-8626; (304) 558-8627

MONTH/YEAR

FEIN

NAME

SCHEDULE

1A

PRODUCT INFORMATION (CHECK APPLICABLE BOX)

MODE OF TRANSPORTATION

□ 150 – #1 Fuel Oil

□ 228 – Diesel – Dyed

□ 054 – Propane

□ 125 – Aviation Gasoline

□ 160 – Diesel – Undyed

□ 224 – Compressed Natural Gas

J – Truck

Report Tax Paid fuel loaded at a

□ 130 – Aviation Jet Fuel

□ 284 – Biodiesel – Undyed

□ 225 – Liquefied Natural Gas

R – Rail

Terminal Rack ONLY from a

□ 122 – Blending Components

□ 072 – Kerosene – Dyed

□ Other – Product Type ___________

licensed permissive supplier

B – Barge

□ 124 – Gasohol

□ 142 – Kerosene – Undyed

Product Code __________

□ 065 – Gasoline

PRODUCT RECEIPT INFORMATION:

YOU MUST COMPLETE SEPARATE SCHEDULES FOR EACH PRODUCT TYPE AND SELLER

(1)

(2)

(3)

(4)

(6)

(7)

(8)

(9)

(10)

(5)

Point of

Transporter

Origin (TCN)

Destination

Net Gallons

INVOICED

Supplier Name

Seller Name

Mode

Date Loaded

Bill of Lading

Gross

Name

GALLONS

Number

Gallons

TOTAL THIS PAGE only

IMPORTANT NOTICE: You must obtain prior approval to submit your own schedules

All columns must be completed for each transaction

TOTAL ALL PAGES

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1