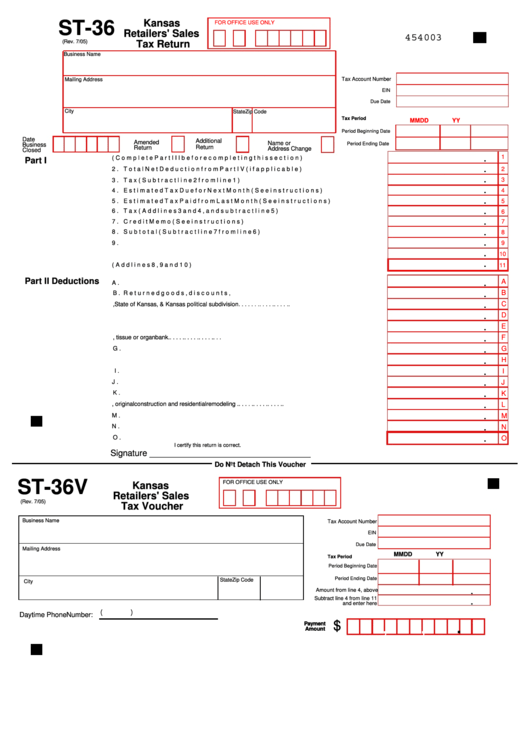

Form St-36 - Kansas Retailers' Sales Tax Return

ADVERTISEMENT

Kansas

ST-36

FOR OFFICE USE ONLY

Retailers' Sales

454003

(Rev. 7/05)

Tax Return

Business Name

Mailing Address

Tax Account Number

EIN

Due Date

City

State

Zip Code

Tax Period

MM

DD

YY

Period Beginning Date

Date

Additional

Amended

Name or

Period Ending Date

Business

Return

Return

Address Change

Closed

.

1

1. Total Tax (Complete Part III before completing this section) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part I

.

2. Total Net Deduction from Part IV (if applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.

3. Tax (Subtract line 2 from line 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

3

.

4. Estimated Tax Due for Next Month (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

5. Estimated Tax Paid from Last Month (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

6. Tax (Add lines 3 and 4, and subtract line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

7. Credit Memo (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

8. Subtotal (Subtract line 7 from line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.

9. Penalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

.

10. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

.

11. Total Amount Due (Add lines 8, 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

Part II Deductions

A

.

A. Sales to other retailers for resale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B

B. Returned goods, discounts, allowances and trade-ins . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

C

.

C. Sales to U.S. government, State of Kansas, & Kansas political subdivision . . . . . . . . . . . . . . . . . .

.

D

D. Sales of ingredient or component parts of tangible personal property produced . . . . . . . . . . . . . . .

E

E. Sales of items consumed in the production of tangible personal property . . . . . . . . . . . . . . . . . . . .

.

.

F

F. Sales to nonprofit hospitals or nonprofit blood banks, tissue or organ bank. . . . . . . . . . . . . . . . . . .

.

G

G. Sales to nonprofit education institutions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H. Sales to qualifying sales tax exempt religious and nonprofit organizations . . . . . . . . . . . . . . . . . . .

.

H

.

I. Sales of farm equipment and machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I

.

J. Sales of manufacturing machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

J

K. Sales of alcoholic beverages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

K

.

L. Non-taxable labor services, original construction and residential remodeling . . . . . . . . . . . . . . . . .

L

.

M. Deliveries outside of Kansas. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

M

.

N. Other allowable deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

N

.

O. Total deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

O

I certify this return is correct.

Signature __________________________________

Do Not Detach This Voucher

ST-36V

FOR OFFICE USE ONLY

Kansas

Retailers' Sales

(Rev. 7/05)

Tax Voucher

Business Name

Tax Account Number

EIN

Due Date

Mailing Address

MM

DD

YY

Tax Period

Period Beginning Date

Period Ending Date

State

Zip Code

City

.

Amount from line 4, above

Subtract line 4 from line 11

.

and enter here

(

)

Daytime Phone Number:

,

,

,

,

.

.

$

$

Payment

Payment

Amount

Amount

401103

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4