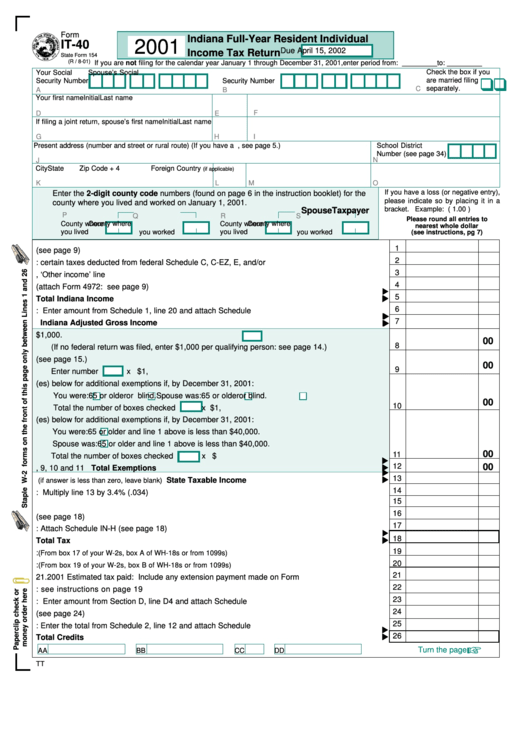

Form

Indiana Full-Year Resident Individual

2001

IT-40

Due April 15, 2002

Income Tax Return

State Form 154

(R / 8-01)

If you are not filing for the calendar year January 1 through December 31, 2001,enter period from: _________to: _________

Check the box if you

Your Social

Spouse’s Social

are married filing

Security Number

Security Number

C

separately.

A

B

Your first name

Initial

Last name

F

D

E

If filing a joint return, spouse’s first name

Initial

Last name

G

H

I

Present address (number and street or rural route) (If you have a P.O. box, see page 5.)

School District

Number (see page 34)

N

J

City

State

Zip Code + 4

Foreign Country

(if applicable)

L

M

O

K

If you have a loss (or negative entry),

Enter the 2-digit county code numbers (found on page 6 in the instruction booklet) for the

please indicate so by placing it in a

county where you lived and worked on January 1, 2001.

bracket. Example: ( 1.00 )

Taxpayer

Spouse

P

Q

R

S

Please round all entries to

County where

County where

County where

County where

nearest whole dollar

you lived

you worked

you lived

you worked

(see instructions, pg 7)

1

1. Enter your federal adjusted gross income from your federal return (see page 9) .........................

2

2. Tax Add-Back: certain taxes deducted from federal Schedule C, C-EZ, E, and/or F ....................

3

3. Net operating loss carryforward from federal Form 1040, ‘Other income’ line ..............................

4

4. Income taxed on federal Form 4972 (attach Form 4972: see page 9) .........................................

5

5. Add lines 1 through 4 ................................................................................Total Indiana Income

6

6. Indiana deductions: Enter amount from Schedule 1, line 20 and attach Schedule 1 ...................

7

7. Line 5 minus line 6 ................................................................. Indiana Adjusted Gross Income

8. Number of exemptions claimed on your federal return

x $1,000.

00

8

(If no federal return was filed, enter $1,000 per qualifying person: see page 14.) ........................

9. Additional exemption for certain dependent children (see page 15.)

00

9

Enter number

x $1,500 .....................................................................................................

10. Check box(es) below for additional exemptions if, by December 31, 2001:

You were:

65 or older

or blind. Spouse was:

65 or older

or blind.

00

10

Total the number of boxes checked

x $1,000 .................................................................

11. Check box(es) below for additional exemptions if, by December 31, 2001:

You were:

65 or older and line 1 above is less than $40,000.

Spouse was:

65 or older and line 1 above is less than $40,000.

00

11

Total the number of boxes checked

x $500 ....................................................................

12

00

12. Add lines 8, 9, 10 and 11 ............................................................................... Total Exemptions

13

13. Line 7 minus line 12

..................... State Taxable Income

(if answer is less than zero, leave blank)

14

14. State adjusted gross income tax: Multiply line 13 by 3.4% (.034) ................................................

15

15. County income tax. See instructions on page 15 .........................................................................

16

16. Use tax due on out-of-state purchases (see page 18) ...................................................................

17

17. Household employment taxes: Attach Schedule IN-H (see page 18) ...........................................

18

18. Add lines 14 through 17. Enter here and on line 27 on the back ................................ Total Tax

19

19. Indiana state tax withheld:

......................

(From box 17 of your W-2s, box A of WH-18s or from 1099s)

20

20. Indiana county tax withheld:

(From box 19 of your W-2s, box B of WH-18s or from 1099s) ...................

21

21. 2001 Estimated tax paid: Include any extension payment made on Form IT-9 ............................

22

22. Unified tax credit for the elderly: see instructions on page 19 .................................................

23

23. Earned income credit: Enter amount from Section D, line D4 and attach Schedule IN-EIC ........

24

24. Lake County residential income tax credit (see page 24) ..............................................................

25

25. Indiana credits: Enter the total from Schedule 2, line 12 and attach Schedule 2 ..........................

26

26. Add lines 19 through 25. Enter here and on line 28 on the back ...........................Total Credits

Turn the page

DD

AA

BB

CC

TT

1

1 2

2 3

3 4

4 5

5