Form Ct-51 - Combined Filer Statement For Newly Formed Groups Only

ADVERTISEMENT

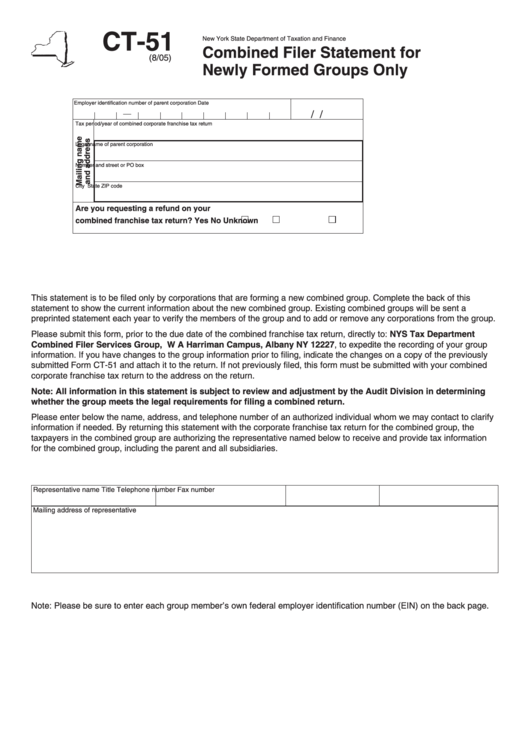

CT-51

New York State Department of Taxation and Finance

Combined Filer Statement for

(8/05)

Newly Formed Groups Only

Employer identification number of parent corporation

Date

/

/

Tax period/year of combined corporate franchise tax return

Legal name of parent corporation

Number and street or PO box

City

State

ZIP code

Are you requesting a refund on your

combined franchise tax return?

Yes

No

Unknown

This statement is to be filed only by corporations that are forming a new combined group. Complete the back of this

statement to show the current information about the new combined group. Existing combined groups will be sent a

preprinted statement each year to verify the members of the group and to add or remove any corporations from the group.

Please submit this form, prior to the due date of the combined franchise tax return, directly to: NYS Tax Department

Combined Filer Services Group, W A Harriman Campus, Albany NY 12227, to expedite the recording of your group

information. If you have changes to the group information prior to filing, indicate the changes on a copy of the previously

submitted Form CT-51 and attach it to the return. If not previously filed, this form must be submitted with your combined

corporate franchise tax return to the address on the return.

Note: All information in this statement is subject to review and adjustment by the Audit Division in determining

whether the group meets the legal requirements for filing a combined return.

Please enter below the name, address, and telephone number of an authorized individual whom we may contact to clarify

information if needed. By returning this statement with the corporate franchise tax return for the combined group, the

taxpayers in the combined group are authorizing the representative named below to receive and provide tax information

for the combined group, including the parent and all subsidiaries.

Representative name

Title

Telephone number

Fax number

Mailing address of representative

Note:

Please be sure to enter each group member’s own federal employer identification number (EIN) on the back page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2