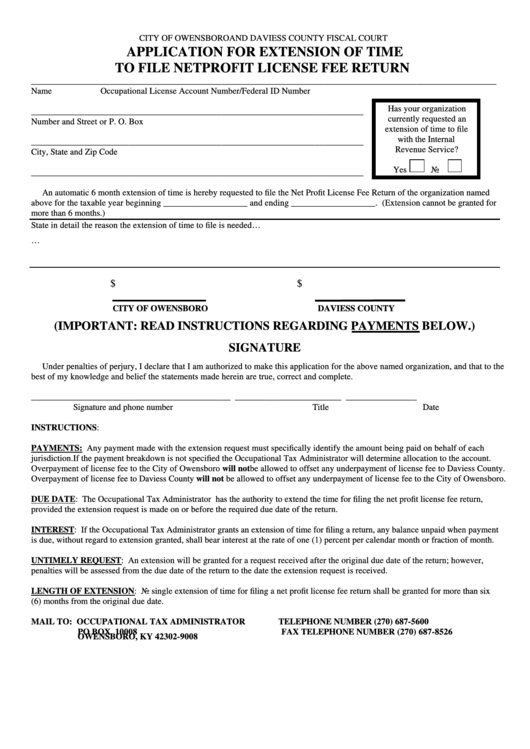

CITY OF OWENSBORO AND DAVIESS COUNTY FISCAL COURT

APPLICATION FOR EXTENSION OF TIME

TO FILE NET PROFIT LICENSE FEE RETURN

_________________________________________________________________________________________________________

Name

Occupational License Account Number/Federal ID Number

Has your organization

___________________________________________________________________________

currently requested an

Number and Street or P. O. Box

extension of time to file

with the Internal

___________________________________________________________________________

Revenue Service?

City, State and Zip Code

Yes

No

___________________________________________________________________________

An automatic 6 month extension of time is hereby requested to file the Net Profit License Fee Return of the organization named

above for the taxable year beginning ___________________ and ending ___________________. (Extension cannot be granted for

more than 6 months.)

State in detail the reason the extension of time to file is needed…......................................................................................................

…......................................................................................................................................................................................................

.........................................................................................................................................................................................................

$

$

CITY OF OWENSBORO

DAVIESS COUNTY

(IMPORTANT: READ INSTRUCTIONS REGARDING PAYMENTS BELOW.)

SIGNATURE

Under penalties of perjury, I declare that I am authorized to make this application for the above named organization, and that to the

best of my knowledge and belief the statements made herein are true, correct and complete.

_____________________________________________

________________________

________________

Signature and phone number

Title

Date

INSTRUCTIONS:

PAYMENTS: Any payment made with the extension request must specifically identify the amount being paid on behalf of each

jurisdiction. If the payment breakdown is not specified the Occupational Tax Administrator will determine allocation to the account.

Overpayment of license fee to the City of Owensboro will not be allowed to offset any underpayment of license fee to Daviess County.

Overpayment of license fee to Daviess County will not be allowed to offset any underpayment of license fee to the City of Owensboro.

DUE DATE: The Occupational Tax Administrator has the authority to extend the time for filing the net profit license fee return,

provided the extension request is made on or before the required due date of the return.

INTEREST: If the Occupational Tax Administrator grants an extension of time for filing a return, any balance unpaid when payment

is due, without regard to extension granted, shall bear interest at the rate of one (1) percent per calendar month or fraction of month.

UNTIMELY REQUEST: An extension will be granted for a request received after the original due date of the return; however,

penalties will be assessed from the due date of the return to the date the extension request is received.

LENGTH OF EXTENSION: No single extension of time for filing a net profit license fee return shall be granted for more than six

(6) months from the original due date.

MAIL TO: OCCUPATIONAL TAX ADMINISTRATOR

TELEPHONE NUMBER (270) 687-5600

PO BOX 10008

FAX TELEPHONE NUMBER (270) 687-8526

OWENSBORO, KY 42302-9008

1

1