FORM

08000165

•

CY

A

Reset Form

LABAMA

65

2008

•

FY

D

R

EPARTMENT OF

EVENUE

•

SY

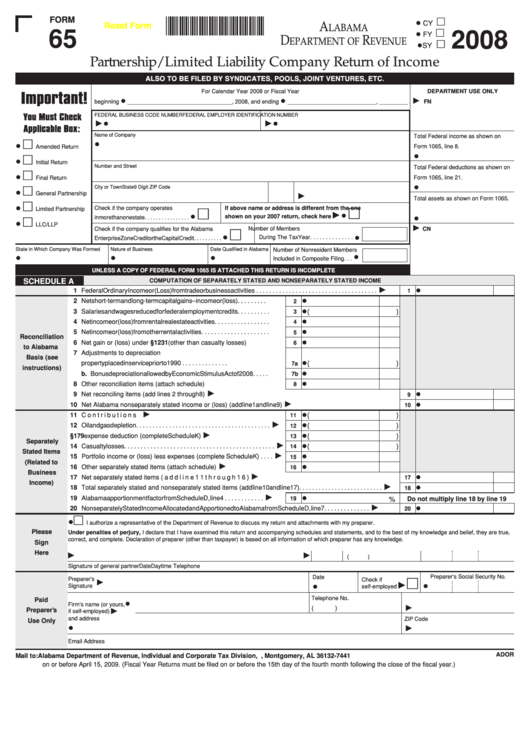

Partnership/Limited Liability Company Return of Income

ALSO TO BE FILED BY SYNDICATES, POOLS, JOINT VENTURES, ETC.

For Calendar Year 2008 or Fiscal Year

DEPARTMENT USE ONLY

Important!

•

•

beginning

_________________________________, 2008, and ending

____________________________, _________

FN

FEDERAL BUSINESS CODE NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

You Must Check

•

•

Applicable Box:

Name of Company

Total Federal income as shown on

•

•

Amended Return

Form 1065, line 8.

•

•

Initial Return

Number and Street

Total Federal deductions as shown on

•

Final Return

Form 1065, line 21.

•

City or Town

State

9 Digit ZIP Code

•

General Partnership

Total assets as shown on Form 1065.

•

Check if the company operates

If above name or address is different from the one

Limited Partnership

•

•

shown on your 2007 return, check here . . . . . . . . . . . . . .

•

in more than one state . . . . . . . . . . . . . . . .

•

LLC/LLP

Check if the company qualifies for the Alabama

Number of Members

CN

•

•

During The Tax Year . . . . . . . . . . . . . .

Enterprise Zone Credit or the Capital Credit . . . . . . . . . .

State in Which Company Was Formed

Nature of Business

Date Qualified in Alabama

Number of Nonresident Members

•

•

•

•

Included in Composite Filing . . .

UNLESS A COPY OF FEDERAL FORM 1065 IS ATTACHED THIS RETURN IS INCOMPLETE

SCHEDULE A

COMPUTATION OF SEPARATELY STATED AND NONSEPARATELY STATED INCOME

•

1 Federal Ordinary Income or (Loss) from trade or business activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

•

2 Net short-term and long-term capital gains – income or (loss) . . . . . . . . .

2

•

3 Salaries and wages reduced for federal employment credits . . . . . . . . . .

(

)

3

•

4 Net income or (loss) from rental real estate activities . . . . . . . . . . . . . . . . .

4

•

5 Net income or (loss) from other rental activities . . . . . . . . . . . . . . . . . . . . .

5

Reconciliation

•

6 Net gain or (loss) under I.R.C. §1231 (other than casualty losses) . . . . .

6

to Alabama

7 Adjustments to depreciation

Basis (see

•

a. Section 179 property placed in service prior to 1990 . . . . . . . . . . . . . .

(

)

7a

instructions)

•

b. Bonus depreciation allowed by Economic Stimulus Act of 2008. . . . .

7b

•

8 Other reconciliation items (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . .

8

•

9 Net reconciling items (add lines 2 through 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

•

10 Net Alabama nonseparately stated income or (loss) (add line 1 and line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

•

11 Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

11

•

(

)

12 Oil and gas depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

•

13 I.R.C. §179 expense deduction (complete Schedule K) . . . . . . . . . . . .

(

)

13

Separately

•

14 Casualty losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(

)

14

Stated Items

•

15 Portfolio income or (loss) less expenses (complete Schedule K) . . . .

15

(Related to

•

16 Other separately stated items (attach schedule) . . . . . . . . . . . . . . . . . .

16

Business

•

17 Net separately stated items (add line 11 through 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Income)

•

18 Total separately stated and nonseparately stated items (add line 10 and line 17). . . . . . . . . . . . . . . . . . . . . . . . . .

18

•

19 Alabama apportionment factor from Schedule D, line 4 . . . . . . . . . . . .

19

%

Do not multiply line 18 by line 19

•

20 Nonseparately Stated Income Allocated and Apportioned to Alabama from Schedule D, line 7 . . . . . . . . . . . . . .

20

•

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

(

)

Signature of general partner

Date

Daytime Telephone No.

Social Security No.

Preparer’s Social Security No.

Date

Preparer’s

Check if

•

•

Signature

self-employed

Telephone No.

E.I. No.

Paid

•

Firm’s name (or yours,

(

)

Preparer’s

if self-employed)

and address

ZIP Code

Use Only

•

Email Address

Mail to: Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327441, Montgomery, AL 36132-7441

ADOR

on or before April 15, 2009. (Fiscal Year Returns must be filed on or before the 15th day of the fourth month following the close of the fiscal year.)

1

1 2

2 3

3