Net Profit Tax Return Form - City Of Stow, Ohio - 2006

ADVERTISEMENT

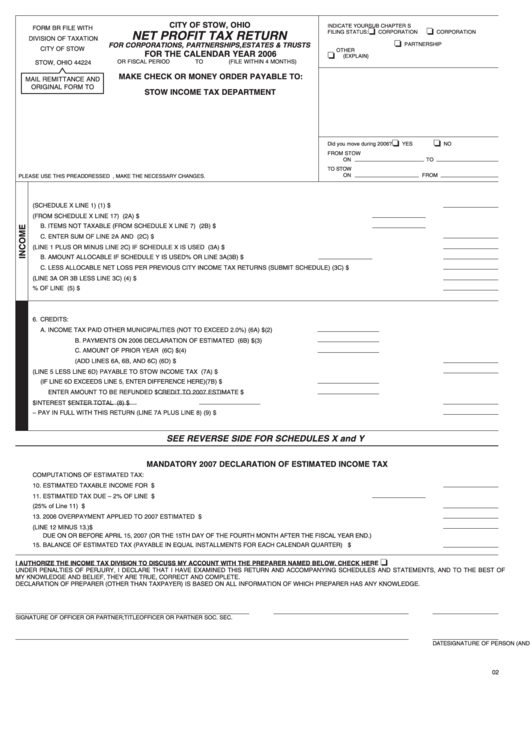

CITY OF STOW, OHIO

INDICATE YOUR

SUB CHAPTER S

FORM BR FILE WITH

❏

❏

FILING STATUS:

CORPORATION

CORPORATION

NET PROFIT TAX RETURN

DIVISION OF TAXATION

❏

FOR CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS

PARTNERSHIP

CITY OF STOW

OTHER

❏

FOR THE CALENDAR YEAR 2006

P.O. BOX 1668

(EXPLAIN) ..........................................................................................

OR FISCAL PERIOD

TO

(FILE WITHIN 4 MONTHS)

STOW, OHIO 44224

MAKE CHECK OR MONEY ORDER PAYABLE TO:

MAIL REMITTANCE AND

ORIGINAL FORM TO

STOW INCOME TAX DEPARTMENT

❏

❏

Did you move during 2006?

YES

NO

FROM STOW

ON

TO

TO STOW

ON

FROM

PLEASE USE THIS PREADDRESSED FORM. IF NAME OR ADDRESS IS INCORRECT, MAKE THE NECESSARY CHANGES.

1. TOTAL TAXABLE INCOME (SCHEDULE X LINE 1)....................................................................................................................................................(1) $

2. A. ITEMS NOT DEDUCTIBLE (FROM SCHEDULE X LINE 17) ADD ............................................................................(2A) $

B. ITEMS NOT TAXABLE (FROM SCHEDULE X LINE 7) DEDUCT ..............................................................................(2B) $

C. ENTER SUM OF LINE 2A AND 2B ......................................................................................................................................................................(2C) $

3. A. ADJUSTED NET INCOME (LINE 1 PLUS OR MINUS LINE 2C) IF SCHEDULE X IS USED ............................................................................(3A) $

B. AMOUNT ALLOCABLE IF SCHEDULE Y IS USED

% OR LINE 3A

(3B) $

C. LESS ALLOCABLE NET LOSS PER PREVIOUS CITY INCOME TAX RETURNS (SUBMIT SCHEDULE) ......................................................(3C) $

4. AMOUNT SUBJECT TO STOW INCOME TAX (LINE 3A OR 3B LESS LINE 3C) ......................................................................................................(4) $

5. STOW INCOME TAX DUE 2.0% OF LINE 4................................................................................................................................................................(5) $

6. CREDITS:

A. INCOME TAX PAID OTHER MUNICIPALITIES (NOT TO EXCEED 2.0%) ................................(6A) $

(2)

B. PAYMENTS ON 2006 DECLARATION OF ESTIMATED TAX................................(6B) $

(3)

C. AMOUNT OF PRIOR YEAR CREDIT ....................................................................(6C) $

(4)

D. TOTAL CREDITS ALLOWABLE (ADD LINES 6A, 6B, AND 6C) ....................................................................................................(6D) $

7. A. BALANCE DUE (LINE 5 LESS LINE 6D) PAYABLE TO STOW INCOME TAX DEPARTMENT ..........................................................................(7A) $

B. OVER PAYMENT CLAIMED (IF LINE 6D EXCEEDS LINE 5, ENTER DIFFERENCE HERE)

(7B) $

ENTER AMOUNT TO BE REFUNDED $

CREDIT TO 2007 ESTIMATE $

8. PENALTY $

INTEREST $

ENTER TOTAL HERE ................................................(8) $

9. TOTAL AMOUNT DUE – PAY IN FULL WITH THIS RETURN (LINE 7A PLUS LINE 8) ............................................................................................(9) $

SEE REVERSE SIDE FOR SCHEDULES X and Y

MANDATORY 2007 DECLARATION OF ESTIMATED INCOME TAX

COMPUTATIONS OF ESTIMATED TAX:

10. ESTIMATED TAXABLE INCOME FOR YEAR ............................................................................................................................................................10 $

11. ESTIMATED TAX DUE – 2% OF LINE 10 ........................................................................................................................11 $

12. First quarter of estimated tax (25% of Line 11) ..........................................................................................................................................................12 $

13. 2006 OVERPAYMENT APPLIED TO 2007 ESTIMATED TAX ....................................................................................................................................13 $

14. NET AMOUNT DUE FOR FIRST QUARTER (LINE 12 MINUS 13.) ..........................................................................................................................14 $

DUE ON OR BEFORE APRIL 15, 2007 (OR THE 15TH DAY OF THE FOURTH MONTH AFTER THE FISCAL YEAR END.)

15. BALANCE OF ESTIMATED TAX (PAYABLE IN EQUAL INSTALLMENTS FOR EACH CALENDAR QUARTER) ....................................................15 $

❏

I AUTHORIZE THE INCOME TAX DIVISION TO DISCUSS MY ACCOUNT WITH THE PREPARER NAMED BELOW. CHECK HERE

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF

MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.

DECLARATION OF PREPARER (OTHER THAN TAXPAYER) IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGNATURE OF OFFICER OR PARTNER; TITLE

OFFICER OR PARTNER SOC. SEC. NO.

DATE

SIGNATURE OF PERSON (AND FIRM) PREPARING RETURN, ADDRESS & PHONE NO.

DATE

02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2