Form Reg-8 - Application For Farmer Tax Exemption Permit - 2014

ADVERTISEMENT

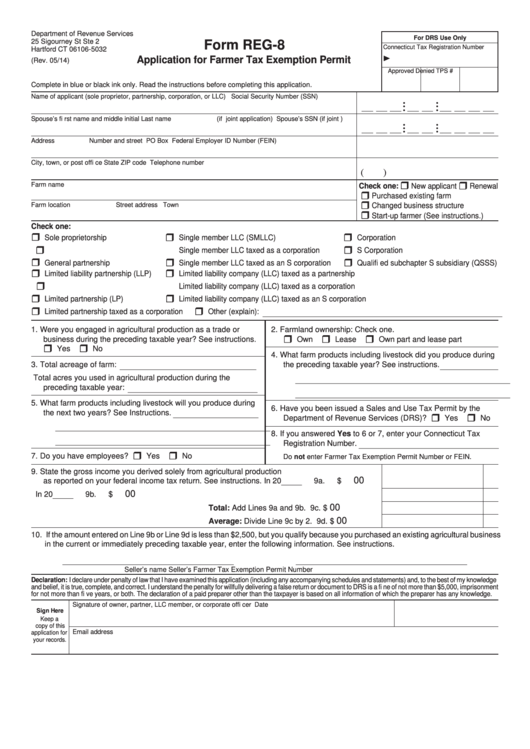

Department of Revenue Services

For DRS Use Only

25 Sigourney St Ste 2

Form REG-8

Connecticut Tax Registration Number

Hartford CT 06106-5032

Application for Farmer Tax Exemption Permit

(Rev. 05/14)

Approved

Denied

TPS #

Complete in blue or black ink only. Read the instructions before completing this application.

Name of applicant (sole proprietor, partnership, corporation, or LLC)

Social Security Number (SSN)

•

•

•

•

•

•

Spouse’s fi rst name and middle initial

Last name

(if joint application)

Spouse’s SSN (if joint )

•

•

•

•

•

•

Address

Number and street

PO Box

Federal Employer ID Number (FEIN)

City, town, or post offi ce

State

ZIP code

Telephone number

(

)

Farm name

Check one:

New applicant

Renewal

Purchased existing farm

Farm location

Street address

Town

Changed business structure

Start-up farmer (See instructions.)

Check one:

Sole proprietorship

Single member LLC (SMLLC)

Corporation

Single member LLC taxed as a corporation

S Corporation

General partnership

Single member LLC taxed as an S corporation

Qualifi ed subchapter S subsidiary (QSSS)

Limited liability partnership (LLP)

Limited liability company (LLC) taxed as a partnership

Limited liability company (LLC) taxed as a corporation

Limited partnership (LP)

Limited liability company (LLC) taxed as an S corporation

Limited partnership taxed as a corporation

Other (explain):

__________________________________________________________________________

1. Were you engaged in agricultural production as a trade or

2. Farmland ownership: Check one.

business during the preceding taxable year? See instructions.

Own

Lease

Own part and lease part

Yes

No

4. What farm products including livestock did you produce during

3. Total acreage of farm:

the preceding taxable year? See instructions.

________________________________________

_________________

Total acres you used in agricultural production during the

_______________________________________________________________

preceding taxable year:

______________________________________

_______________________________________________________________

5. What farm products including livestock will you produce during

6. Have you been issued a Sales and Use Tax Permit by the

the next two years? See Instructions.

_________________________

Department of Revenue Services (DRS)?

Yes

No

_______________________________________________________________

8. If you answered Yes to 6 or 7, enter your Connecticut Tax

_______________________________________________________________

Registration Number.

_________________________________________

7. Do you have employees?

Yes

No

Do not enter Farmer Tax Exemption Permit Number or FEIN.

9. State the gross income you derived solely from agricultural production

00

as reported on your federal income tax return. See instructions.

In 20

9a. $

______

00

In 20

9b. $

______

00

Total: Add Lines 9a and 9b.

9c. $

00

Average: Divide Line 9c by 2.

9d. $

10. If the amount entered on Line 9b or Line 9d is less than $2,500, but you qualify because you purchased an existing agricultural business

in the current or immediately preceding taxable year, enter the following information. See instructions.

Seller’s name

Seller’s Farmer Tax Exemption Permit Number

Declaration: I declare under penalty of law that I have examined this application (including any accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne of not more than $5,000, imprisonment

for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature of owner, partner, LLC member, or corporate offi cer

Date

Sign Here

Keep a

copy of this

Email address

application for

your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2