Form K-60 - Community Service Contribution Credit

ADVERTISEMENT

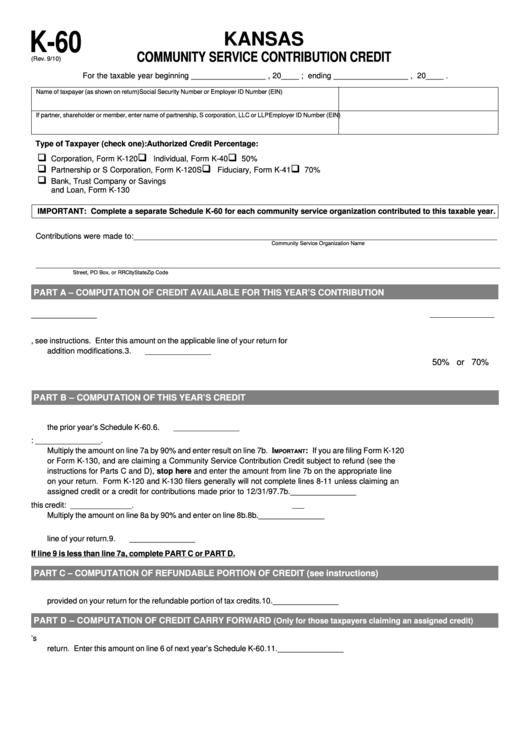

K-60

KANSAS

COMMUNITY SERVICE CONTRIBUTION CREDIT

(Rev. 9/10)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

Type of Taxpayer (check one):

Authorized Credit Percentage:

q

q

q

Corporation, Form K-120

Individual, Form K-40

50%

q

q

q

Partnership or S Corporation, Form K-120S

Fiduciary, Form K-41

70%

q

Bank, Trust Company or Savings

and Loan, Form K-130

IMPORTANT: Complete a separate Schedule K-60 for each community service organization contributed to this taxable year.

Contributions were made to: ___________________________________________________________________________________

Community Service Organization Name

__________________________________________________________________________________________________________

Street, PO Box, or RR

City

State

Zip Code

PART A – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S CONTRIBUTION

1. Total contributions made to the approved community service organization this tax year.

1.

_______________

2. Enter your proportionate share percentage. See instructions.

2.

_______________

3. Multiply line 1 by line 2, see instructions. Enter this amount on the applicable line of your return for

addition modifications.

3.

_______________

50% or 70%

4. Authorized credit percentage. See instructions for appropriate percentage.

4.

_______________

5. Your share of the credit for the contributions made this year. Multiply line 3 by line 4.

5.

_______________

PART B – COMPUTATION OF THIS YEAR’S CREDIT

6. Total amount of carry forward available on this return. Enter the amount of available carry forward from

the prior year’s Schedule K-60.

6.

_______________

7a. Total credit available this tax year. Add lines 5 and 6 and enter the result here: _______________.

Multiply the amount on line 7a by 90% and enter result on line 7b. I

: If you are filing Form K-120

MPORTANT

or Form K-130, and are claiming a Community Service Contribution Credit subject to refund (see the

instructions for Parts C and D), stop here and enter the amount from line 7b on the appropriate line

on your return. Form K-120 and K-130 filers generally will not complete lines 8-11 unless claiming an

assigned credit or a credit for contributions made prior to 12/31/97.

7b.

_______________

8a. Amount of your Kansas tax liability for this tax year to be applied against this credit: ______________.

Multiply the amount on line 8a by 90% and enter on line 8b.

8b.

_______________

9. Amount of credit this tax year. Enter the lesser of lines 7b or 8b. Enter this amount on the appropriate

line of your return.

9.

_______________

If line 9 is less than line 7a, complete PART C or PART D.

PART C – COMPUTATION OF REFUNDABLE PORTION OF CREDIT (see instructions)

10. Subtract line 9 from line 7b. This is the excess credit to be refunded. Enter this amount on the line

provided on your return for the refundable portion of tax credits.

10.

_______________

PART D – COMPUTATION OF CREDIT CARRY FORWARD

(Only for those taxpayers claiming an assigned credit)

11. Subtract line 8a from line 7a. This is the amount of excess credit available to carry forward to next year’s

return. Enter this amount on line 6 of next year’s Schedule K-60.

11.

_______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1