Form K-33 - Kansas Agritourism Liability Insurance Credit

ADVERTISEMENT

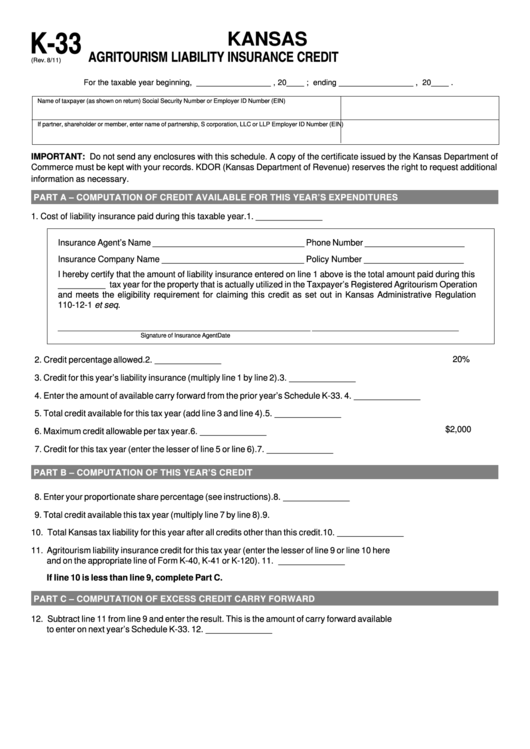

K-33

KANSAS

AGRITOURISM LIABILITY INSURANCE CREDIT

(Rev. 8/11)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

IMPORTANT: Do not send any enclosures with this schedule. A copy of the certificate issued by the Kansas Department of

Commerce must be kept with your records. KDOR (Kansas Department of Revenue) reserves the right to request additional

information as necessary.

PART A – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S EXPENDITURES

1. Cost of liability insurance paid during this taxable year.

1. ______________

Insurance Agent’s Name ________________________________ Phone Number _____________________

Insurance Company Name ______________________________ Policy Number _____________________

I hereby certify that the amount of liability insurance entered on line 1 above is the total amount paid during this

__________ tax year for the property that is actually utilized in the Taxpayer’s Registered Agritourism Operation

and meets the eligibility requirement for claiming this credit as set out in Kansas Administrative Regulation

110-12-1 et seq.

__________________________________________________________________________

___________________________________________

Signature of Insurance Agent

Date

20%

2. Credit percentage allowed.

2. ______________

3. Credit for this year’s liability insurance (multiply line 1 by line 2).

3. ______________

4. Enter the amount of available carry forward from the prior year’s Schedule K-33.

4. ______________

5. Total credit available for this tax year (add line 3 and line 4).

5. ______________

$2,000

6. Maximum credit allowable per tax year.

6. ______________

7. Credit for this tax year (enter the lesser of line 5 or line 6).

7. ______________

PART B – COMPUTATION OF THIS YEAR’S CREDIT

8. Enter your proportionate share percentage (see instructions).

8. ______________

9. Total credit available this tax year (multiply line 7 by line 8).

9.

10. Total Kansas tax liability for this year after all credits other than this credit.

10. ______________

11. Agritourism liability insurance credit for this tax year (enter the lesser of line 9 or line 10 here

and on the appropriate line of Form K-40, K-41 or K-120).

11. ______________

If line 10 is less than line 9, complete Part C.

PART C – COMPUTATION OF EXCESS CREDIT CARRY FORWARD

12. Subtract line 11 from line 9 and enter the result. This is the amount of carry forward available

to enter on next year’s Schedule K-33.

12. ______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1