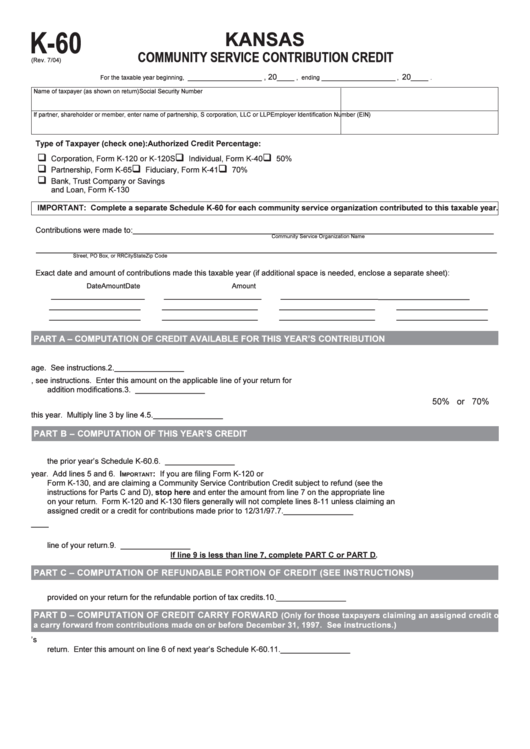

Form K-60 - Kansas Community Service Contribution Credit

ADVERTISEMENT

K-60

KANSAS

COMMUNITY SERVICE CONTRIBUTION CREDIT

(Rev. 7/04)

_________________ , 20____

_________________

20____

For the taxable year beginning,

, ending

,

.

Name of taxpayer (as shown on return)

Social Security Number

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

Type of Taxpayer (check one):

Authorized Credit Percentage:

q

q

q

Corporation, Form K-120 or K-120S

Individual, Form K-40

50%

q

q

q

Partnership, Form K-65

Fiduciary, Form K-41

70%

q

Bank, Trust Company or Savings

and Loan, Form K-130

IMPORTANT: Complete a separate Schedule K-60 for each community service organization contributed to this taxable year.

Contributions were made to: ___________________________________________________________________________________

Community Service Organization Name

__________________________________________________________________________________________________________

Street, PO Box, or RR

City

State

Zip Code

Exact date and amount of contributions made this taxable year (if additional space is needed, enclose a separate sheet):

Date

Amount

Date

Amount

_____________________

________________________

_________________________

_________________________

_____________________

______________________

______________________

_____________________

_____________________

______________________

______________________

_____________________

PART A – COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S CONTRIBUTION

1. Total contributions made to the approved community service organization this tax year.

1. ________________

2. Enter your ownership percentage. See instructions.

2. ________________

3. Multiply line 1 by line 2, see instructions. Enter this amount on the applicable line of your return for

addition modifications.

3. ________________

50% or 70%

4. Authorized credit percentage. Circle one.

4. ________________

5. Your share of the credit for the contributions made this year. Multiply line 3 by line 4.

5. ________________

PART B – COMPUTATION OF THIS YEAR’S CREDIT

6. Total amount of carry forward available on this return. Enter the amount of available carry forward from

the prior year’s Schedule K-60.

6. ________________

7. Total credit available this tax year. Add lines 5 and 6. I

: If you are filing Form K-120 or

MPORTANT

Form K-130, and are claiming a Community Service Contribution Credit subject to refund (see the

instructions for Parts C and D), stop here and enter the amount from line 7 on the appropriate line

on your return. Form K-120 and K-130 filers generally will not complete lines 8-11 unless claiming an

assigned credit or a credit for contributions made prior to 12/31/97.

7. ________________

8. Enter your total tax liability for this tax year after all credits other than this credit. See instructions.

8. ________________

9. Amount of credit this tax year. Enter the lesser of lines 7 or 8. Enter this amount on the appropriate

line of your return.

9. ________________

If line 9 is less than line 7, complete PART C or PART D.

PART C – COMPUTATION OF REFUNDABLE PORTION OF CREDIT (SEE INSTRUCTIONS)

10. Subtract line 9 from line 7. This is the excess credit to be refunded. Enter this amount on the line

provided on your return for the refundable portion of tax credits.

10. ________________

PART D – COMPUTATION OF CREDIT CARRY FORWARD

(Only for those taxpayers claiming an assigned credit or

a carry forward from contributions made on or before December 31, 1997. See instructions.)

11. Subtract line 9 from line 7. This is the amount of excess credit available to carry forward to next year’s

return. Enter this amount on line 6 of next year’s Schedule K-60.

11. ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2