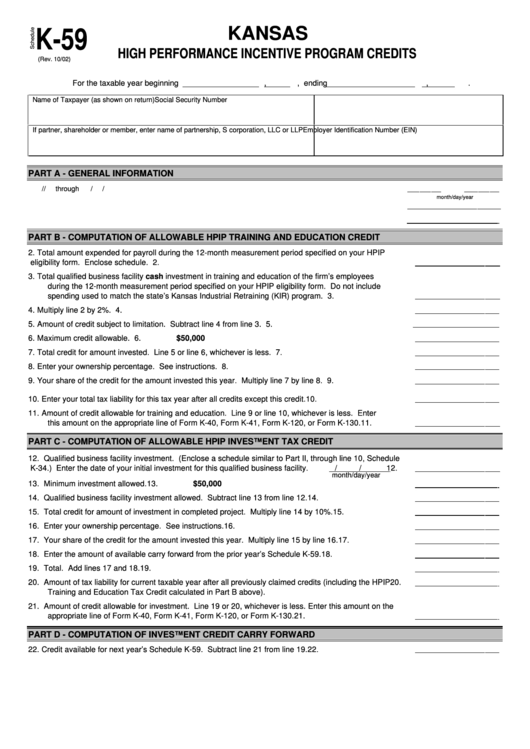

Form K-59 - Kansas High Performance Incentive Program Credits

ADVERTISEMENT

KANSAS

K-59

HIGH PERFORMANCE INCENTIVE PROGRAM CREDITS

(Rev. 10/02)

For the taxable year beginning

,

, ending

,

.

Name of Taxpayer (as shown on return)

Social Security Number

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

PART A - GENERAL INFORMATION

1a. Enter the period for which you were HPIP certified by the Secretary of Commerce.

1a.

/

/

through

/

/

month/day/year

1b. Enter your HPIP certification letter number.

1b.

1c. Enter the SIC code or NAICS designation of the Certified Firm.

1c.

PART B - COMPUTATION OF ALLOWABLE HPIP TRAINING AND EDUCATION CREDIT

2.

Total amount expended for payroll during the 12-month measurement period specified on your HPIP

eligibility form. Enclose schedule.

2.

3.

Total qualified business facility cash investment in training and education of the firm’s employees

during the 12-month measurement period specified on your HPIP eligibility form. Do not include

spending used to match the state’s Kansas Industrial Retraining (KIR) program.

3.

4.

Multiply line 2 by 2%.

4.

5.

Amount of credit subject to limitation. Subtract line 4 from line 3.

5.

6.

Maximum credit allowable.

6.

$50,000

7.

Total credit for amount invested. Line 5 or line 6, whichever is less.

7.

8.

Enter your ownership percentage. See instructions.

8.

9.

Your share of the credit for the amount invested this year. Multiply line 7 by line 8.

9.

10.

Enter your total tax liability for this tax year after all credits except this credit.

10.

11.

Amount of credit allowable for training and education. Line 9 or line 10, whichever is less. Enter

this amount on the appropriate line of Form K-40, Form K-41, Form K-120, or Form K-130.

11.

PART C - COMPUTATION OF ALLOWABLE HPIP INVESTMENT TAX CREDIT

12.

Qualified business facility investment. (Enclose a schedule similar to Part II, through line 10, Schedule

K-34.) Enter the date of your initial investment for this qualified business facility.

/

/

12.

month/day/year

13.

Minimum investment allowed.

13.

$50,000

14.

Qualified business facility investment allowed. Subtract line 13 from line 12.

14.

15.

Total credit for amount of investment in completed project. Multiply line 14 by 10%.

15.

16.

Enter your ownership percentage. See instructions.

16.

17.

Your share of the credit for the amount invested this year. Multiply line 15 by line 16.

17.

18.

Enter the amount of available carry forward from the prior year’s Schedule K-59.

18.

19.

Total. Add lines 17 and 18.

19.

20.

Amount of tax liability for current taxable year after all previously claimed credits (including the HPIP

20.

Training and Education Tax Credit calculated in Part B above).

21.

Amount of credit allowable for investment. Line 19 or 20, whichever is less. Enter this amount on the

appropriate line of Form K-40, Form K-41, Form K-120, or Form K-130.

21.

PART D - COMPUTATION OF INVESTMENT CREDIT CARRY FORWARD

22. Credit available for next year’s Schedule K-59. Subtract line 21 from line 19.

22.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1