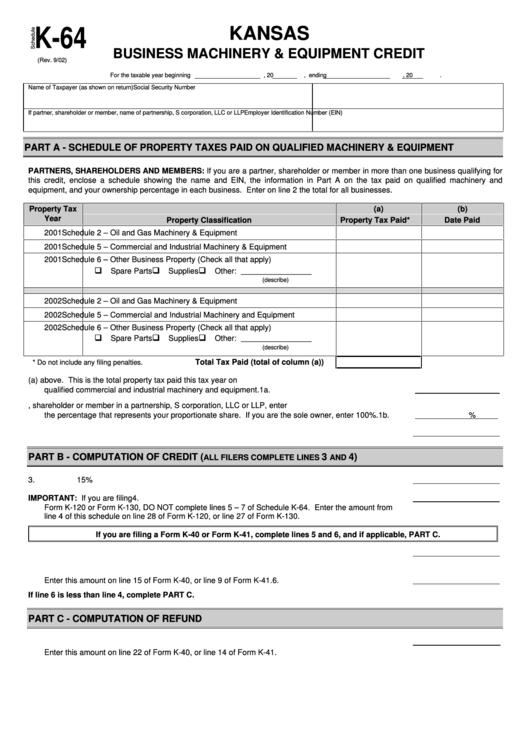

Form K-64 - Kansas Business Machinery & Equipment Credit

ADVERTISEMENT

KANSAS

K-64

BUSINESS MACHINERY & EQUIPMENT CREDIT

(Rev. 9/02)

For the taxable year beginning

, 20

, ending

, 20

.

Name of Taxpayer (as shown on return)

Social Security Number

If partner, shareholder or member, name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

PART A - SCHEDULE OF PROPERTY TAXES PAID ON QUALIFIED MACHINERY & EQUIPMENT

PARTNERS, SHAREHOLDERS AND MEMBERS: If you are a partner, shareholder or member in more than one business qualifying for

this credit, enclose a schedule showing the name and EIN, the information in Part A on the tax paid on qualified machinery and

equipment, and your ownership percentage in each business. Enter on line 2 the total for all businesses.

Property Tax

(a)

(b)

Year

Property Classification

Property Tax Paid*

Date Paid

2001

Schedule 2 – Oil and Gas Machinery & Equipment

2001

Schedule 5 – Commercial and Industrial Machinery & Equipment

2001

Schedule 6 – Other Business Property (Check all that apply)

q

q

q

________________

Spare Parts

Supplies

Other:

(describe)

2002

Schedule 2 – Oil and Gas Machinery & Equipment

2002

Schedule 5 – Commercial and Industrial Machinery and Equipment

2002

Schedule 6 – Other Business Property (Check all that apply)

q

q

q

________________

Spare Parts

Supplies

Other:

(describe)

Total Tax Paid (total of column (a))

* Do not include any filing penalties.

1a. Enter the total from column (a) above. This is the total property tax paid this tax year on

qualified commercial and industrial machinery and equipment.

1a.

1b. If you are a partner, shareholder or member in a partnership, S corporation, LLC or LLP, enter

the percentage that represents your proportionate share. If you are the sole owner, enter 100%.

1b.

%

2.

Total property tax eligible for credit. Multiply line 1a by line 1b.

2.

PART B - COMPUTATION OF CREDIT (

3

4)

ALL FILERS COMPLETE LINES

AND

3.

Credit percentage allowed.

3.

15%

4.

Total credit available this tax year. Multiply line 2 by line 3. IMPORTANT: If you are filing

4.

Form K-120 or Form K-130, DO NOT complete lines 5 – 7 of Schedule K-64. Enter the amount from

line 4 of this schedule on line 28 of Form K-120, or line 27 of Form K-130.

If you are filing a Form K-40 or Form K-41, complete lines 5 and 6, and if applicable, PART C.

5.

Enter your total tax liability for this tax year after all credits other than this credit.

5.

6.

Credit this tax year. Enter the lesser of lines 4 or 5.

Enter this amount on line 15 of Form K-40, or line 9 of Form K-41.

6.

If line 6 is less than line 4, complete PART C.

PART C - COMPUTATION OF REFUND

7.

Subtract line 6 from line 4. This is the amount of excess credit to be refunded.

7.

Enter this amount on line 22 of Form K-40, or line 14 of Form K-41.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1