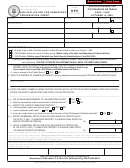

INSTRUCTIONS FOR SCHEDULE K-35

GENERAL INFORMATION

transferred credit on line 3 of Part C. Otherwise enter the acquired

credit carry forward on line 6, Part D.

K.S.A. 79-32,211 provides a tax credit against the income, privilege

PART C – COMPUTATION OF CREDIT AVAILABLE

or premium tax for certain historic preservation project expenditures.

The credit is available to a qualified taxpayer that makes qualified

LINE 1 – Enter the total qualified expenses to rehabilitate the

expenditures to restore or preserve a qualified historic structure

structure. This amount must be $5,000 or larger. Do not include

according to a qualified rehabilitation plan. The amount of the

costs attributable to associated additions, furnishings, land,

credit is 25% of qualified expenditures when the total amount of the

landscaping, lighting fixtures, parking lots, site work etc.

expenditures equals $5,000 or more.

LINE 2 – Circle the appropriate percentage for the credit amount,

For tax years beginning after December 31, 2006, the amount of

either 25% or 30% of the qualified expenditures. See the General

the credit is 30% of qualified expenditures incurred and paid in the

Information section for an explanation of these percentages.

restoration and preservation of a qualified historic structure which is

LINE 3 – Multiply line 1 by the appropriate percentage on line 2.

exempt from federal income taxation pursuant to section 501(c)(3)

This is the total credit available. Acquired credits: If this is your

of the IRC and which is not income producing pursuant to a qualified

first year to claim a credit transferred from another, enter on line

3 the total amount of the credit transferred as shown on your

rehabilitation plan by a qualified taxpayer. The total amount of such

Certificate of Transfer.

expenditures must equal $5,000 or more in order to claim the credit.

LINE 4 – Partners, shareholders and members of pass-through

Partners, shareholders and members of a pass-through entity

entities: Enter the percentage that represents your proportionate

will claim this credit in the same manner as they account for their

share in the credit. All other taxpayers: Enter 100%.

proportionate shares of the income or loss of that entity.

LINE 5 – Multiply line 3 by line 4. This is the amount of this year’s

If the tax credit exceeds the income, privilege or premium tax

credit available to your income or privilege tax return.

liability for the year in which the qualified rehabilitation plan was

placed in service, the excess credit may be carried forward to the

K-120S filers STOP HERE. This is your established credit amount.

next succeeding year(s) until the total credit has been used except

PART D – COMPUTATION OF THIS YEAR'S CREDIT

that no credit may be carried over for deduction after the 10th taxable

year succeeding the year in which the qualified rehabilitation plan

LINE 6 – Enter any carry forward amount from line 10 of your prior

was placed in service.

year’s Schedule K-35.

Tax credits allowed and earned may be sold, assigned or

LINE 7 – Add lines 5 and 6. This is your total credit available this tax

otherwise transferred to a taxpayer (assignee) who may use the

year.

acquired credit against its tax liability for either the tax year the

LINE 8 – Enter your Kansas tax liability after all credits other than

qualified rehabilitation plan was first placed in service or the year in

this credit.

which the credit was acquired. Unused credit amounts claimed by

LINE 9 – Enter the lesser of lines 7 or 8. Enter this amount on the

an assignee may be carried forward for up to 5 years, except that all

appropriate line of Form K-40, Form K-41, Form K-120 or Form

such amounts shall be claimed within 10 years following the tax year

K-130. If line 9 is less than line 7, complete line 10.

in which the qualified rehabilitation plan was first placed into service.

PART E – COMPUTATION OF CREDIT CARRY FORWARD

The amount received by the assignor of the tax credit shall be taxable

as income of the assignor. The excess of the value of the credit over

LINE 10 – Subtract line 9 from line 7. This is the amount of credit

the amount paid by the assignee for the credit shall be taxable as

available to enter on line 6 of your next year’s Schedule K-35.

income to the assignee.

A qualified taxpayer is the owner of the qualified historic structure

IMPORTANT: Do not send any enclosures with this schedule,

or any other person who may qualify for the federal rehabilitation

however, be sure to keep copies of the following with your

credit allowed by section 47 of the federal internal revenue code.

records as the Kansas Department of Revenue reserves the

A qualified historic structure is any building, whether or not

right to request additional information as necessary.

income producing, which is defined as a certified historic structure by

• Tax credit certificate from the Kansas State Historical Society.

section 47(c)(3) of the federal internal revenue code, is individually

• Federal Form 3468, if applicable.

listed on the register of Kansas historic places, or is located and

• Itemized list of actual costs and expenses.

contributes to a district listed on the register of Kansas historic places.

• Certificate of Transfer from the Kansas State Historical Society

A qualified rehabilitation plan is a project that has been

if you are claiming an acquired credit.

approved by the Cultural Resources Division of the Kansas State

Historical Society, or by a local government certified by the division

TAXPAYER ASSISTANCE

to so approve. The plan must be consistent with the standards and

guidelines for rehabilitation of historical buildings as adopted by the

For information and assistance with the federal and state

federal secretary of interior.

rehabilitation credits contact:

Qualified expenditures are costs and expenses incurred by a

qualified taxpayer in the restoration and preservation of the qualified

Cultural Resources Division

Kansas State Historical Society

historic structure according to the approved plan which are defined

6425 SW 6th Ave.

as a qualified rehabilitation expenditure by section 47(c)(2) of the

Topeka, KS 66615-1099

federal internal revenue code.

Phone: 785-272-8681 Ext. 240

SPECIFIC LINE INSTRUCTIONS

Fax: 785-272-8682

Complete a separate schedule for each qualified historic structure.

PART A – HISTORIC STRUCTURE INFORMATION

For assistance in completing this schedule contact the Kansas

Department of Revenue:

Enter project number, certification number, and the name and

address of the qualified historic structure. If the building is known by

By mail

Walk-in

a historic name, include this as well as the complete address of the

Tax Operations

Taxpayer Assistance Center

property.

Docking State Office Building

Scott Office Building

PART B – REHABILITATION PROJECT INFORMATION

915 SW Harrison St.

120 SE 10th Ave.

Topeka, KS 66612-1588

Topeka, KS

Complete

the

requested

information

about

the

certified

rehabilitation project. The state credit is generally available the same

Phone: 785-368-8222

tax year as the federal credit is taken. If the project does not qualify

Fax: 785-291-3614

for the federal credit, the state credit is taken the year in which the

Additional copies of this credit schedule and other tax forms are

qualified rehabilitation plan was placed in service. If this is your

available from our website at:

first year to claim an acquired credit, enter the total amount of the

1

1 2

2