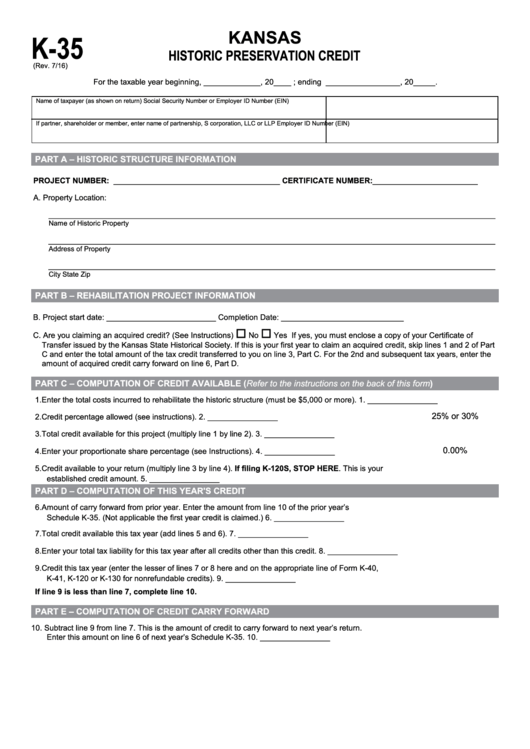

K-35

KANSAS

HISTORIC PRESERVATION CREDIT

(Rev. 7/16)

For the taxable year beginning, _____________ , 20 ____ ; ending _________________ , 20 _____.

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – HISTORIC STRUCTURE INFORMATION

PROJECT NUMBER: ______________________________________

CERTIFICATE NUMBER:________________________

A. Property Location:

______________________________________________________________________________________________________

Name of Historic Property

______________________________________________________________________________________________________

Address of Property

______________________________________________________________________________________________________

City

State

Zip

PART B – REHABILITATION PROJECT INFORMATION

B. Project start date: _________________________

Completion Date: ____________________________

o

o

C. Are you claiming an acquired credit? (See Instructions)

No

Yes If yes, you must enclose a copy of your Certificate of

Transfer issued by the Kansas State Historical Society. If this is your first year to claim an acquired credit, skip lines 1 and 2 of Part

C and enter the total amount of the tax credit transferred to you on line 3, Part C. For the 2nd and subsequent tax years, enter the

amount of acquired credit carry forward on line 6, Part D.

PART C – COMPUTATION OF CREDIT AVAILABLE (Refer to the instructions on the back of this form)

1. Enter the total costs incurred to rehabilitate the historic structure (must be $5,000 or more).

1.

________________

25% or 30%

2. Credit percentage allowed (see instructions).

2.

________________

3. Total credit available for this project (multiply line 1 by line 2).

3.

________________

4. Enter your proportionate share percentage (see Instructions).

4.

________________

0.00%

5. Credit available to your return (multiply line 3 by line 4). If filing K-120S, STOP HERE. This is your

established credit amount.

5.

________________

PART D – COMPUTATION OF THIS YEAR'S CREDIT

6. Amount of carry forward from prior year. Enter the amount from line 10 of the prior year’s

Schedule K-35. (Not applicable the first year credit is claimed.)

6.

________________

7. Total credit available this tax year (add lines 5 and 6).

7.

________________

8. Enter your total tax liability for this tax year after all credits other than this credit.

8.

________________

9. Credit this tax year (enter the lesser of lines 7 or 8 here and on the appropriate line of Form K-40,

K-41, K-120 or K-130 for nonrefundable credits).

9.

________________

If line 9 is less than line 7, complete line 10.

PART E – COMPUTATION OF CREDIT CARRY FORWARD

10. Subtract line 9 from line 7. This is the amount of credit to carry forward to next year’s return.

Enter this amount on line 6 of next year’s Schedule K-35.

10.

________________

1

1 2

2