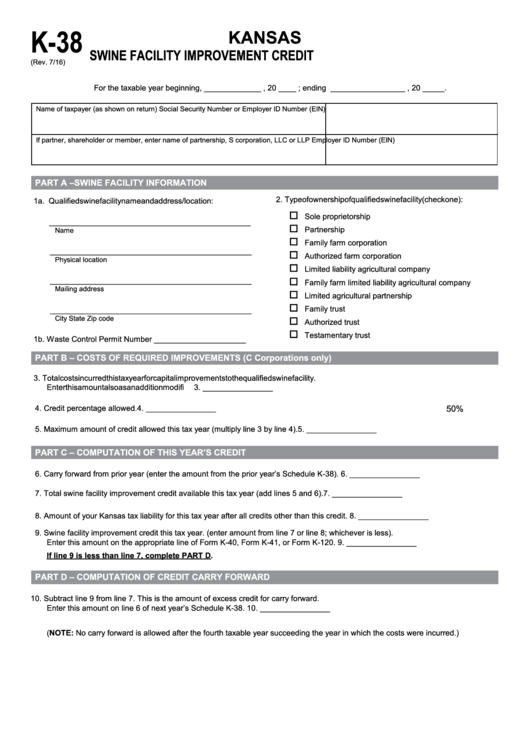

K-38

KANSAS

SWINE FACILITY IMPROVEMENT CREDIT

(Rev. 7/16)

For the taxable year beginning, _____________ , 20 ____ ; ending _________________ , 20 _____.

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A –SWINE FACILITY INFORMATION

1a. Qualified swine facility name and address/location:

2. Type of ownership of qualified swine facility (check one):

o

Sole proprietorship

______________________________________________

o

Partnership

Name

o

Family farm corporation

______________________________________________

o

Authorized farm corporation

Physical location

o

Limited liability agricultural company

______________________________________________

o

Family farm limited liability agricultural company

Mailing address

o

Limited agricultural partnership

o

Family trust

______________________________________________

City

State

Zip code

o

Authorized trust

o

Testamentary trust

1b. Waste Control Permit Number _____________________

PART B – COSTS OF REQUIRED IMPROVEMENTS (C Corporations only)

3. Total costs incurred this tax year for capital improvements to the qualified swine facility.

Enter this amount also as an addition modification on your return. See instructions.

3.

________________

50%

4. Credit percentage allowed.

4.

________________

5. Maximum amount of credit allowed this tax year (multiply line 3 by line 4).

5.

________________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

6. Carry forward from prior year (enter the amount from the prior year’s Schedule K-38).

6.

________________

7. Total swine facility improvement credit available this tax year (add lines 5 and 6).

7.

________________

8. Amount of your Kansas tax liability for this tax year after all credits other than this credit.

8.

________________

9. Swine facility improvement credit this tax year. (enter amount from line 7 or line 8; whichever is less).

Enter this amount on the appropriate line of Form K-40, Form K-41, or Form K-120.

9.

________________

If line 9 is less than line 7, complete PART D.

PART D – COMPUTATION OF CREDIT CARRY FORWARD

10. Subtract line 9 from line 7. This is the amount of excess credit for carry forward.

Enter this amount on line 6 of next year’s Schedule K-38.

10.

________________

(NOTE: No carry forward is allowed after the fourth taxable year succeeding the year in which the costs were incurred.)

1

1 2

2