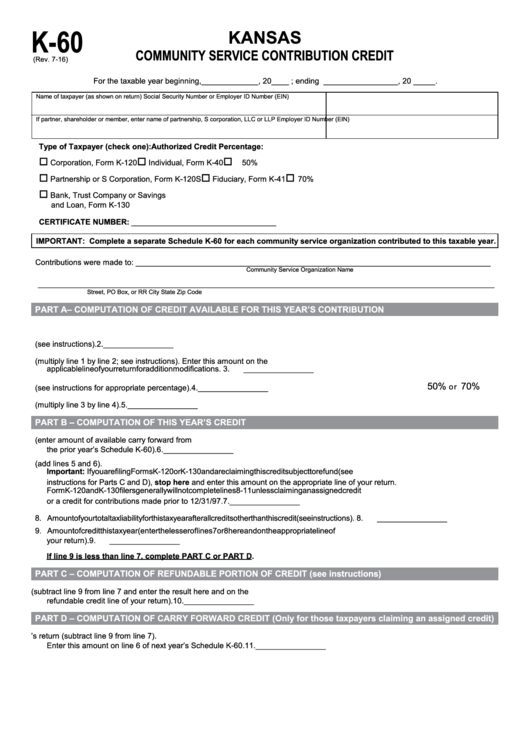

K-60

KANSAS

COMMUNITY SERVICE CONTRIBUTION CREDIT

(Rev. 7-16)

For the taxable year beginning, _____________ , 20 ____ ; ending _________________ , 20 _____.

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

Type of Taxpayer (check one):

Authorized Credit Percentage:

o

o

o

Corporation, Form K-120

Individual, Form K-40

50%

o

o

o

Partnership or S Corporation, Form K-120S

Fiduciary, Form K-41

70%

o

Bank, Trust Company or Savings

and Loan, Form K-130

CERTIFICATE NUMBER: _________________________________

IMPORTANT: Complete a separate Schedule K-60 for each community service organization contributed to this taxable year.

Contributions were made to: _________________________________________________________________________________

Community Service Organization Name

______________________________________________________________________________________________________________________________________

Street, PO Box, or RR

City

State

Zip Code

PART A– COMPUTATION OF CREDIT AVAILABLE FOR THIS YEAR’S CONTRIBUTION

1. Total contributions made to the approved community service organization this tax year.

1.

________________

2. Enter your proportionate share percentage (see instructions).

2.

________________

3. Your share of contributions (multiply line 1 by line 2; see instructions). Enter this amount on the

applicable line of your return for addition modifications.

3.

________________

50%

70%

o r

4. Authorized credit percentage (see instructions for appropriate percentage).

4.

________________

5. Your share of the credit for the contributions made this year (multiply line 3 by line 4).

5.

________________

PART B – COMPUTATION OF THIS YEAR’S CREDIT

6. Total amount of carry forward available on this return (enter amount of available carry forward from

the prior year’s Schedule K-60).

6.

________________

7. Total credit available this tax year (add lines 5 and 6).

Important: If you are filing Forms K-120 or K-130 and are claiming this credit subject to refund (see

instructions for Parts C and D), stop here and enter this amount on the appropriate line of your return.

Form K-120 and K-130 filers generally will not complete lines 8-11 unless claiming an assigned credit

or a credit for contributions made prior to 12/31/97.

7.

________________

8. Amount of your total tax liability for this tax year after all credits other than this credit (see instructions).

8.

________________

9. Amount of credit this tax year (enter the lesser of lines 7 or 8 here and on the appropriate line of

your return).

9.

________________

If line 9 is less than line 7, complete PART C or PART D.

PART C – COMPUTATION OF REFUNDABLE PORTION OF CREDIT (see instructions)

10. Excess credit to be refunded (subtract line 9 from line 7 and enter the result here and on the

refundable credit line of your return).

10.

________________

PART D – COMPUTATION OF CARRY FORWARD CREDIT (Only for those taxpayers claiming an assigned credit)

11. Amount of excess credit available to carry forward to next year’s return (subtract line 9 from line 7).

Enter this amount on line 6 of next year’s Schedule K-60.

11.

________________

1

1