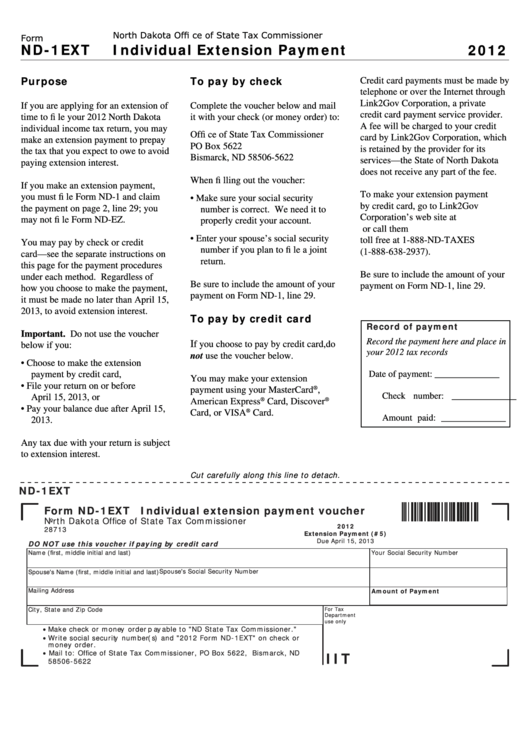

Form Nd-1ext - Individual Extension Payment Voucher - 2012

ADVERTISEMENT

North Dakota Offi ce of State Tax Commissioner

Form

ND-1EXT

Individual Extension Payment

2012

Purpose

To pay by check

Credit card payments must be made by

telephone or over the Internet through

Link2Gov Corporation, a private

If you are applying for an extension of

Complete the voucher below and mail

credit card payment service provider.

time to fi le your 2012 North Dakota

it with your check (or money order) to:

A fee will be charged to your credit

individual income tax return, you may

Offi ce of State Tax Commissioner

card by Link2Gov Corporation, which

make an extension payment to prepay

PO Box 5622

is retained by the provider for its

the tax that you expect to owe to avoid

Bismarck, ND 58506-5622

services—the State of North Dakota

paying extension interest.

does not receive any part of the fee.

When fi lling out the voucher:

If you make an extension payment,

To make your extension payment

you must fi le Form ND-1 and claim

• Make sure your social security

by credit card, go to Link2Gov

the payment on page 2, line 29; you

number is correct. We need it to

Corporation’s web site at

may not fi le Form ND-EZ.

properly credit your account.

or call them

• Enter your spouse’s social security

toll free at 1-888-ND-TAXES

You may pay by check or credit

number if you plan to fi le a joint

(1-888-638-2937).

card—see the separate instructions on

return.

this page for the payment procedures

Be sure to include the amount of your

under each method. Regardless of

Be sure to include the amount of your

payment on Form ND-1, line 29.

how you choose to make the payment,

payment on Form ND-1, line 29.

it must be made no later than April 15,

2013, to avoid extension interest.

To pay by credit card

Record of payment

Important. Do not use the voucher

Record the payment here and place in

I

f you choose to pay by credit card, do

below if you:

your 2012 tax records

not use the voucher below.

• Choose to make the extension

payment by credit card,

Date of payment: ______________

You may make your extension

• File your return on or before

payment using your MasterCard

®

,

Check number: ______________

April 15, 2013, or

®

®

American Express

Card, Discover

• Pay your balance due after April 15,

®

Card, or VISA

Card.

Amount paid: ______________

2013.

Any tax due with your return is subject

to extension interest.

Cut carefully along this line to detach.

ND-1EXT

Form ND-1EXT Individual extension payment voucher

North Dakota Office of State Tax Commissioner

2012

28713

Extension Payment (#5)

Due April 15, 2013

DO NOT use this voucher if paying by credit card

Name (first, middle initial and last)

Your Social Security Number

Spouse's Social Security Number

Spouse's Name (first, middle initial and last)

Mailing Address

Amount of Payment

City, State and Zip Code

For Tax

Department

use only

Make check or money order payable to "ND State Tax Commissioner."

•

Write social security number(s) and "2012 Form ND-1EXT" on check or

•

money order.

Mail to: Office of State Tax Commissioner, PO Box 5622, Bismarck, ND

IIT

•

58506-5622

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1