Form Dtf-24 - Application For New Jersey/new York Simplified Sales And Use Tax Reportiing

ADVERTISEMENT

DTF-24 (1/05)

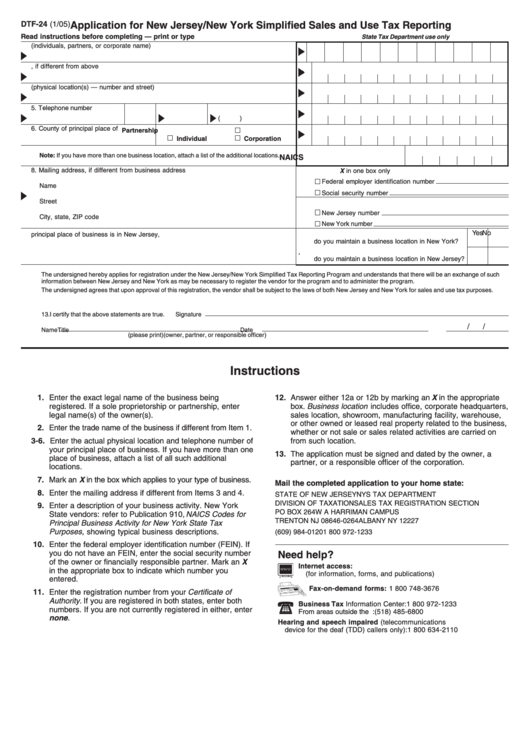

Application for New Jersey/New York Simplified Sales and Use Tax Reporting

Read instructions before completing — print or type

State Tax Department use only

1. Legal name of business (individuals, partners, or corporate name)

2. Trade name, if different from above

3. Address of principal place of business (physical location(s) — number and street)

4. City

State

ZIP code

5. Telephone number

(

)

6. County of principal place of business

7. Type of organization

Partnership

Individual

Corporation

Note: If you have more than one business location, attach a list of the additional locations.

NAICS ............................

8. Mailing address, if different from business address

10. Mark an X in one box only

Federal employer identification number

Name

Social security number

Street

11. Current sales tax registration numbers

New Jersey number

City, state, ZIP code

New York number

9. Business description

Yes

No

12a. If your principal place of business is in New Jersey,

do you maintain a business location in New York?

12b. If your principal place of business is in New York,

do you maintain a business location in New Jersey?

The undersigned hereby applies for registration under the New Jersey/New York Simplified Tax Reporting Program and understands that there will be an exchange of such

information between New Jersey and New York as may be necessary to register the vendor for the program and to administer the program.

The undersigned agrees that upon approval of this registration, the vendor shall be subject to the laws of both New Jersey and New York for sales and use tax purposes.

13. I certify that the above statements are true.

Signature

/

/

Name

Title

Date

(please print)

(owner, partner, or responsible officer)

Instructions

1. Enter the exact legal name of the business being

12. Answer either 12a or 12b by marking an X in the appropriate

registered. If a sole proprietorship or partnership, enter

box. Business location includes office, corporate headquarters,

legal name(s) of the owner(s).

sales location, showroom, manufacturing facility, warehouse,

or other owned or leased real property related to the business,

2. Enter the trade name of the business if different from Item 1.

whether or not sale or sales related activities are carried on

3-6. Enter the actual physical location and telephone number of

from such location.

your principal place of business. If you have more than one

13. The application must be signed and dated by the owner, a

place of business, attach a list of all such additional

partner, or a responsible officer of the corporation.

locations.

7. Mark an X in the box which applies to your type of business.

Mail the completed application to your home state:

8. Enter the mailing address if different from Items 3 and 4.

STATE OF NEW JERSEY

NYS TAX DEPARTMENT

DIVISION OF TAXATION

SALES TAX REGISTRATION SECTION

9. Enter a description of your business activity. New York

PO BOX 264

W A HARRIMAN CAMPUS

State vendors: refer to Publication 910, NAICS Codes for

TRENTON NJ 08646-0264

ALBANY NY 12227

Principal Business Activity for New York State Tax

Purposes, showing typical business descriptions.

(609) 984-0120

1 800 972-1233

10. Enter the federal employer identification number (FEIN). If

you do not have an FEIN, enter the social security number

Need help?

of the owner or financially responsible partner. Mark an X

Internet access:

in the appropriate box to indicate which number you

(for information, forms, and publications)

entered.

Fax-on-demand forms:

1 800 748-3676

11. Enter the registration number from your Certificate of

Authority. If you are registered in both states, enter both

Business Tax Information Center:

1 800 972-1233

numbers. If you are not currently registered in either, enter

From areas outside the U.S. and outside Canada:

(518) 485-6800

none .

Hearing and speech impaired (telecommunications

device for the deaf (TDD) callers only):

1 800 634-2110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1