Short-Term Rental Tax Return 2008 Form

ADVERTISEMENT

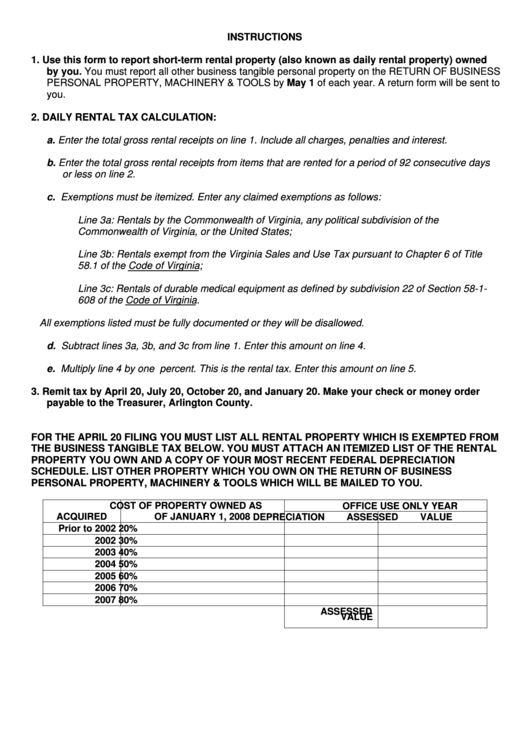

INSTRUCTIONS

1. Use this form to report short-term rental property (also known as daily rental property) owned

by you. You must report all other business tangible personal property on the RETURN OF BUSINESS

PERSONAL PROPERTY, MACHINERY & TOOLS by May 1 of each year. A return form will be sent to

you.

2. DAILY RENTAL TAX CALCULATION:

a. Enter the total gross rental receipts on line 1. Include all charges, penalties and interest.

b. Enter the total gross rental receipts from items that are rented for a period of 92 consecutive days

or less on line 2.

c. Exemptions must be itemized. Enter any claimed exemptions as follows:

Line 3a:

Rentals by the Commonwealth of Virginia, any political subdivision of the

Commonwealth of Virginia, or the United States;

Line 3b:

Rentals exempt from the Virginia Sales and Use Tax pursuant to Chapter 6 of Title

58.1 of the Code of Virginia;

Line 3c:

Rentals of durable medical equipment as defined by subdivision 22 of Section 58-1-

608 of the Code of Virginia.

All exemptions listed must be fully documented or they will be disallowed.

d. Subtract lines 3a, 3b, and 3c from line 1. Enter this amount on line 4.

e. Multiply line 4 by one percent. This is the rental tax. Enter this amount on line 5.

3. Remit tax by April 20, July 20, October 20, and January 20. Make your check or money order

payable to the Treasurer, Arlington County.

FOR THE APRIL 20 FILING YOU MUST LIST ALL RENTAL PROPERTY WHICH IS EXEMPTED FROM

THE BUSINESS TANGIBLE TAX BELOW. YOU MUST ATTACH AN ITEMIZED LIST OF THE RENTAL

PROPERTY YOU OWN AND A COPY OF YOUR MOST RECENT FEDERAL DEPRECIATION

SCHEDULE. LIST OTHER PROPERTY WHICH YOU OWN ON THE RETURN OF BUSINESS

PERSONAL PROPERTY, MACHINERY & TOOLS WHICH WILL BE MAILED TO YOU.

YEAR

COST OF PROPERTY OWNED AS

OFFICE USE ONLY

ACQUIRED

OF JANUARY 1, 2008

DEPRECIATION

ASSESSED VALUE

Prior to 2002

20%

2002

30%

2003

40%

2004

50%

2005

60%

2006

70%

2007

80%

ASSESSED

VALUE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5