Form Fiia-09 - Application For Transfer Or Sale Of Tax Credit Form

ADVERTISEMENT

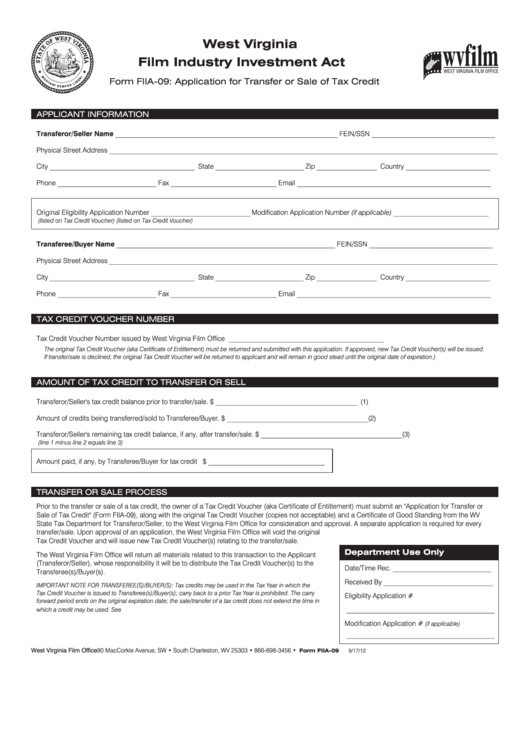

West V ir ginia

Film Indust r y Invest ment Act

Form FIIA-09: Application for Transfer or Sale of Tax Credit

APPLICANT INFORMATION

Transferor/Seller Name _______________________________________________________________ FEIN/SSN ___________________________________

Physical Street Address ______________________________________________________________________________________________________________

City _________________________________________ State _________________________ Zip _________________ Country ________________________

Phone ____________________________ Fax ______________________________ Email _______________________________________________________

Original Eligibility Application Number ____________________________ Modification Application Number (if applicable) ___________________________

(listed on Tax Credit Voucher)

(listed on Tax Credit Voucher)

Transferee/Buyer Name ______________________________________________________________ FEIN/SSN ___________________________________

Physical Street Address ______________________________________________________________________________________________________________

City _________________________________________ State _________________________ Zip _________________ Country ________________________

Phone ____________________________ Fax ______________________________ Email _______________________________________________________

TA X CREDIT VOUCHER NUMBER

Tax Credit Voucher Number issued by West Virginia Film Office

____________________________________________

The original Tax Credit Voucher (aka Certificate of Entitlement) must be returned and submitted with this application. If approved, new Tax Credit Voucher(s) will be issued.

If transfer/sale is declined, the original Tax Credit Voucher will be returned to applicant and will remain in good stead until the original date of expiration.)

AMOUNT OF TA X CREDIT TO TR ANSFER OR SELL

Transferor/Seller's tax credit balance prior to transfer/sale.

$ ________________________________________ (1)

Amount of credits being transferred/sold to Transferee/Buyer.

$ ________________________________________ (2)

Transferor/Seller's remaining tax credit balance, if any, after transfer/sale.

$ ________________________________________ (3)

(line 1 minus line 2 equals line 3)

Amount paid, if any, by Transferee/Buyer for tax credit $ _________________________________

TR ANSFER OR SALE PROCESS

Prior to the transfer or sale of a tax credit, the owner of a Tax Credit Voucher (aka Certificate of Entitlement) must submit an "Application for Transfer or

Sale of Tax Credit" (Form FIIA-09), along with the original Tax Credit Voucher (copies not acceptable) and a Certificate of Good Standing from the WV

State Tax Department for Transferor/Seller, to the West Virginia Film Office for consideration and approval. A separate application is required for every

transfer/sale. Upon approval of an application, the West Virginia Film Office will void the original

Tax Credit Voucher and will issue new Tax Credit Voucher(s) relating to the transfer/sale.

Department Use Only

The West Virginia Film Office will return all materials related to this transaction to the Applicant

(Transferor/Seller), whose responsibility it will be to distribute the Tax Credit Voucher(s) to the

Date/Time Rec. ____________________________

Transferee(s)/Buyer(s).

Received By _______________________________

IMPORTANT NOTE FOR TRANSFEREE(S)/BUYER(S): Tax credits may be used in the Tax Year in which the

Tax Credit Voucher is issued to Transferee(s)/Buyer(s); carry back to a prior Tax Year is prohibited. The carry

Eligibility Application #

forward period ends on the original expiration date; the sale/transfer of a tax credit does not extend the time in

__________________________________________

which a credit may be used. See W.Va. Code 11-13X-8.

Modification Application #

(if applicable)

__________________________________________

West Virginia Film Office 90 MacCorkle Avenue, SW • South Charleston, WV 25303 • 866-698-3456 •

Form FIIA-09

9/17/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2