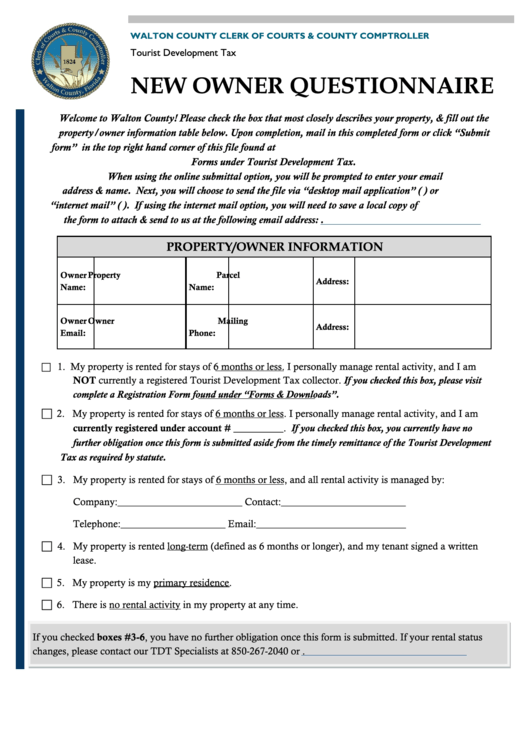

W A L T O N C O U N T Y C L E R K O F C O U R T S & C O U N T Y C O M P T R O L L E R

Tourist Development Tax

NEW OWNER QUESTIONNAIRE

Welcome to Walton County! Please check the box that most closely describes your property, & fill out the

property/owner information table below. Upon completion, mail in this completed form or click “Submit

form” in the top right hand corner of this file found at by clicking

Forms under Tourist Development Tax.

When using the online submittal option, you will be prompted to enter your email

address & name. Next, you will choose to send the file via “desktop mail application” (i.e. Outlook) or

“internet mail” (i.e. Gmail or Yahoo). If using the internet mail option, you will need to save a local copy of

the form to attach & send to us at the following email address: touristdevelopmenttax@co.walton.fl.us.

PROPERTY/OWNER INFORMATION

Owner

Property

Parcel

Name:

Name:

Address:

Owner

Owner

Mailing

Email:

Phone:

Address:

1. My property is rented for stays of 6 months or less. I personally manage rental activity, and I am

NOT currently a registered Tourist Development Tax collector. If you checked this box, please visit

to complete a Registration Form found under “Forms & Downloads”.

2. My property is rented for stays of 6 months or less. I personally manage rental activity, and I am

currently registered under account # __________. If you checked this box, you currently have no

further obligation once this form is submitted aside from the timely remittance of the Tourist Development

Tax as required by statute.

3. My property is rented for stays of 6 months or less, and all rental activity is managed by:

Company:_________________________ Contact:_________________________

Telephone:_____________________ Email:______________________________

4. My property is rented long-term (defined as 6 months or longer), and my tenant signed a written

lease.

5. My property is my primary residence.

6. There is no rental activity in my property at any time.

If you checked boxes #3-6, you have no further obligation once this form is submitted. If your rental status

changes, please contact our TDT Specialists at 850-267-2040 or touristdevelopmenttax@co.walton.fl.us.

1

1