Form Idr 57-122a - Application For Industrial Property Tax Exemption

ADVERTISEMENT

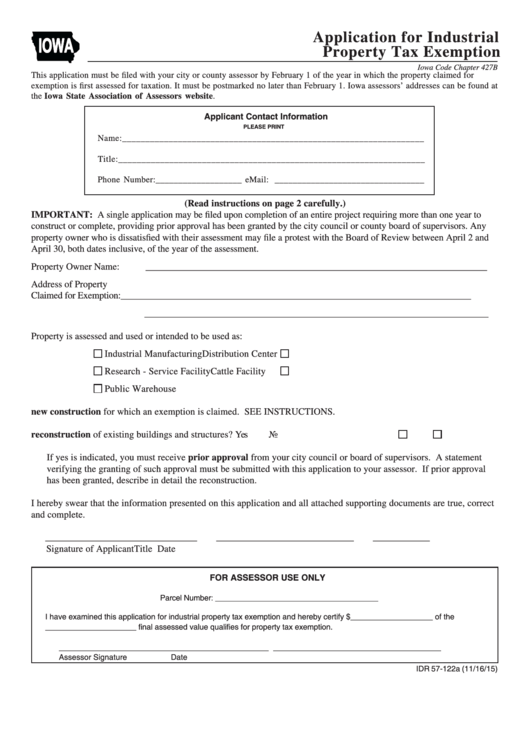

Application for Industrial

IOWA

Property Tax Exemption

Iowa Code Chapter 427B

This application must be filed with your city or county assessor by February 1 of the year in which the property claimed for

exemption is first assessed for taxation. It must be postmarked no later than February 1. Iowa assessors’ addresses can be found at

the Iowa State Association of Assessors website.

Applicant Contact Information

PLEASE PRINT

Name:_________________________________________________________________

Title:__________________________________________________________________

Phone Number:___________________ eMail: _________________________________

(Read instructions on page 2 carefully.)

IMPORTANT: A single application may be filed upon completion of an entire project requiring more than one year to

construct or complete, providing prior approval has been granted by the city council or county board of supervisors. Any

property owner who is dissatisfied with their assessment may file a protest with the Board of Review between April 2 and

April 30, both dates inclusive, of the year of the assessment.

Property Owner Name:

________________________________________________________________________

Address of Property

Claimed for Exemption:

________________________________________________________________________________

_________________________________________________________________________

Property is assessed and used or intended to be used as:

Industrial Manufacturing

Distribution Center

Research - Service Facility

Cattle Facility

Public Warehouse

1. Describe in detail the new construction for which an exemption is claimed. SEE INSTRUCTIONS.

2. Is this exemption being claimed for reconstruction of existing buildings and structures?

Yes

No

If yes is indicated, you must receive prior approval from your city council or board of supervisors. A statement

verifying the granting of such approval must be submitted with this application to your assessor. If prior approval

has been granted, describe in detail the reconstruction.

I hereby swear that the information presented on this application and all attached supporting documents are true, correct

and complete.

________________________________

_____________________________

____________

Signature of Applicant

Title

Date

FOR ASSESSOR USE ONLY

Parcel Number: ______________________________________

I have examined this application for industrial property tax exemption and hereby certify $___________________ of the

_____________________ final assessed value qualifies for property tax exemption.

_____________________________________________ ____________________________________

Assessor Signature

Date

IDR 57-122a (11/16/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2