Petition To Local Board Of Review - Regular Session Form - Iowa State Association Of Assessors

ADVERTISEMENT

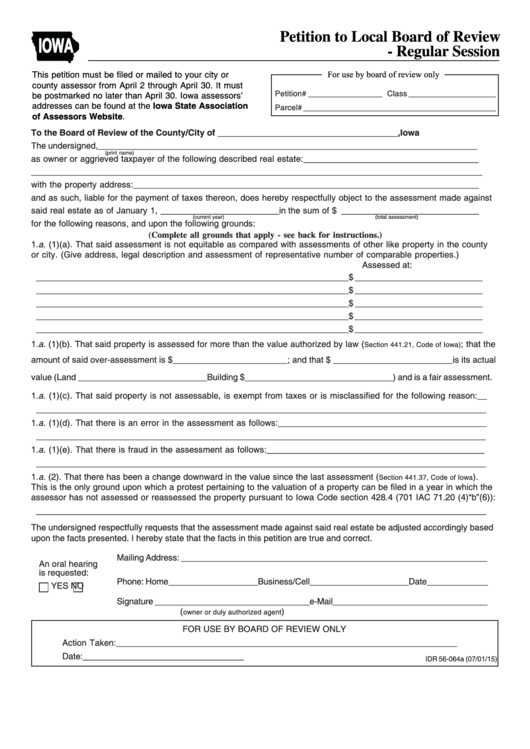

Petition to Local Board of Review

IOWA

- Regular Session

For use by board of review only

This petition must be filed or mailed to your city or

county assessor from April 2 through April 30. It must

Petition # _________________ Class ____________________

be postmarked no later than April 30. Iowa assessors’

addresses can be found at the Iowa State Association

Parcel # ____________________________________________

of Assessors Website.

To the Board of Review of the County/City of ______________________________________ ,Iowa

The undersigned, ________________________________________________________________________________

(print name)

as owner or aggrieved taxpayer of the following described real estate: _____________________________________

_________________________________________________________________________________________________

with the property address: _________________________________________________________________________

and as such, liable for the payment of taxes thereon, does hereby respectfully object to the assessment made against

said real estate as of January 1, _________________________ in the sum of $ _____________________________

(current year)

(total assessment)

for the following reasons, and upon the following grounds:

(Complete all grounds that apply - see back for instructions.)

1.a. (1)(a). That said assessment is not equitable as compared with assessments of other like property in the county

or city. (Give address, legal description and assessment of representative number of comparable properties.)

Assessed at:

__________________________________________________________________ $ ___________________________

__________________________________________________________________ $ ___________________________

__________________________________________________________________ $ ___________________________

__________________________________________________________________ $ ___________________________

__________________________________________________________________ $ ___________________________

1.a. (1)(b). That said property is assessed for more than the value authorized by law (

; that the

Section 441.21, Code of Iowa)

amount of said over-assessment is $________________________; and that $ _________________________is its actual

value (Land ___________________________Building $_______________________________) and is a fair assessment.

1.a. (1)(c). That said property is not assessable, is exempt from taxes or is misclassified for the following reason: __

_______________________________________________________________________________________________

1.a. (1)(d). That there is an error in the assessment as follows: ____________________________________________

_______________________________________________________________________________________________

1.a. (1)(e). That there is fraud in the assessment as follows: ______________________________________________

_______________________________________________________________________________________________

1.a. (2). That there has been a change downward in the value since the last assessment (

).

Section 441.37, Code of Iowa

This is the only ground upon which a protest pertaining to the valuation of a property can be filed in a year in which the

assessor has not assessed or reassessed the property pursuant to Iowa Code section 428.4 (701 IAC 71.20 (4)“b”(6)):

_______________________________________________________________________________________________

The undersigned respectfully requests that the assessment made against said real estate be adjusted accordingly based

upon the facts presented. I hereby state that the facts in this petition are true and correct.

Mailing Address: _________________________________________________________________

An oral hearing

is requested:

Phone: Home___________________Business/Cell_____________________Date_____________

YES

NO

Signature _________________________________e-Mail_________________________________

(

)

owner or duly authorized agent

FOR USE BY BOARD OF REVIEW ONLY

Action Taken: ________________________________________________________________________

Date: __________________________________

IDR 56-064a (07/01/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2