Business Questionnaire Form - North Carolina Department Of Revenue

ADVERTISEMENT

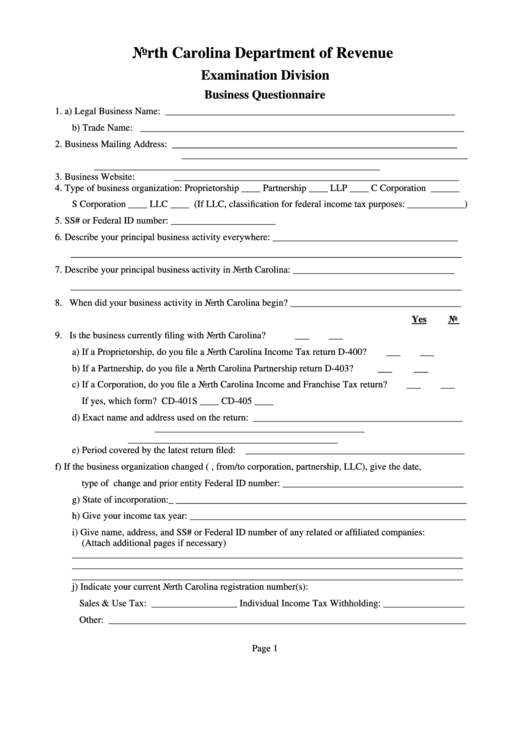

North Carolina Department of Revenue

Examination Division

Business Questionnaire

1. a) Legal Business Name: _____________________________________________________________

b) Trade Name: ____________________________________________________________________

2. Business Mailing Address: ____________________________________________________________

____________________________________________________________

____________________________________________________________

3. Business Website:

____________________________________________________________

4. Type of business organization: Proprietorship ____ Partnership ____ LLP ____ C Corporation ______

S Corporation ____ LLC ____ (If LLC, classification for federal income tax purposes: ____________)

5. SS# or Federal ID number: ______________________

6. Describe your principal business activity everywhere: _______________________________________

__________________________________________________________________________________

7. Describe your principal business activity in North Carolina: __________________________________

__________________________________________________________________________________

8. When did your business activity in North Carolina begin? ____________________________________

Yes

No

9. Is the business currently filing with North Carolina?

___

___

a) If a Proprietorship, do you file a North Carolina Income Tax return D-400?

___

___

b) If a Partnership, do you file a North Carolina Partnership return D-403?

___

___

c) If a Corporation, do you file a North Carolina Income and Franchise Tax return?

___

___

If yes, which form? CD-401S ____ CD-405 ____

d) Exact name and address used on the return: ____________________________________________

____________________________________________

____________________________________________

e) Period covered by the latest return filed: ______________________________________________

f) If the business organization changed (i.e., from/to corporation, partnership, LLC), give the date,

type of change and prior entity Federal ID number: ______________________________________

g) State of incorporation:_ _____________________________________________________________

h) Give your income tax year: __________________________________________________________

i) Give name, address, and SS# or Federal ID number of any related or affiliated companies:

(Attach additional pages if necessary)

__________________________________________________________________________________

__________________________________________________________________________________

__________________________________________________________________________________

j) Indicate your current North Carolina registration number(s):

Sales & Use Tax: __________________ Individual Income Tax Withholding: _________________

Other: ___________________________________________________________________________

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2