State Form 49188 - Schedule It-20comp - Shareholders' Composite Indiana Adjusted Gross Income Tax Return 2001 - Department Of Revenue

ADVERTISEMENT

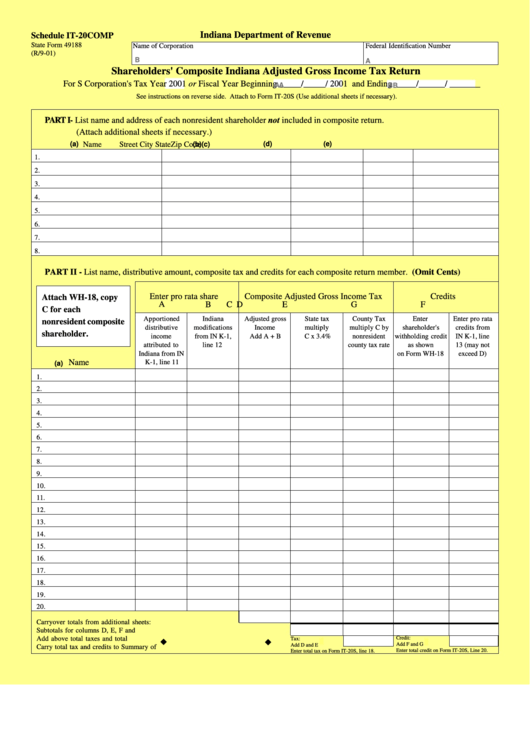

Indiana Department of Revenue

Schedule IT-20COMP

State Form 49188

Name of Corporation

Federal Identification Number

(R/9-01)

B

A

Shareholders' Composite Indiana Adjusted Gross Income Tax Return

For S Corporation's Tax Year 2001 or Fiscal Year Beginning _____/_____/ 2001 and Ending _____/______/ _______

AA

BB

See instructions on reverse side. Attach to Form IT-20S (Use additional sheets if necessary).

PART I - List name and address of each nonresident shareholder not included in composite return.

(Attach additional sheets if necessary.)

(d)

(e)

(a)

Name

(b)

Street

(c)

City

State

Zip Code

1.

2.

3.

4.

5.

6.

7.

8.

PART II - List name, distributive amount, composite tax and credits for each composite return member. (Omit Cents)

Enter pro rata share

Composite Adjusted Gross Income Tax

Credits

Attach WH-18, copy

A

B

C

D

E

F

G

C for each

Apportioned

Indiana

Adjusted gross

State tax

County Tax

Enter

Enter pro rata

nonresident composite

distributive

modifications

Income

multiply

multiply C by

shareholder's

credits from

shareholder.

income

from IN K-1,

Add A + B

C x 3.4%

nonresident

withholding credit

IN K-1, line

attributed to

line 12

county tax rate

as shown

13 (may not

Indiana from IN

on Form WH-18

exceed D)

Name

K-1, line 11

(a)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

Carryover totals from additional sheets:..................................................

Subtotals for columns D, E, F and G.....................................................................................

Add above total taxes and total credits..................................................................................

Credit:

Tax:

Add F and G

Add D and E

Carry total tax and credits to Summary of Calculations........................................................

Enter total credit on Form IT-20S, Line 20.

Enter total tax on Form IT-20S, line 18.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1