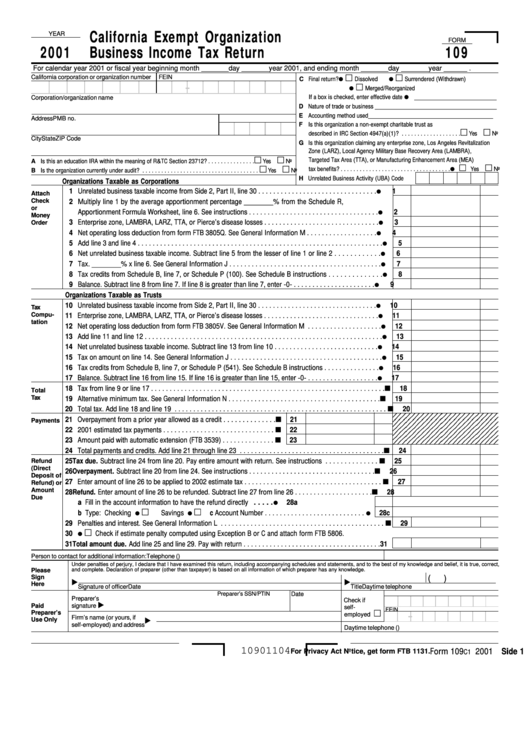

Form 109 - California Exempt Organization Business Income Tax Return - 2001

ADVERTISEMENT

California Exempt Organization

YEAR

FORM

2001

Business Income Tax Return

109

For calendar year 2001 or fiscal year beginning month _______ day _______ year 2001, and ending month _______ day _______ year ______ .

¼

¼

California corporation or organization number

FEIN

C Final return?

Dissolved

Surrendered (Withdrawn)

-

¼

Merged/Reorganized

¼

_________________________

If a box is checked, enter effective date

Corporation/organization name

D Nature of trade or business ________________________________________

E Accounting method used _________________________________________

Address

PMB no.

F Is this organization a non-exempt charitable trust as

described in IRC Section 4947(a)(1)? . . . . . . . . . . . . . . . . . . .

Yes

No

City

State

ZIP Code

G Is this organization claiming any enterprise zone, Los Angeles Revitalization

Zone (LARZ), Local Agency Military Base Recovery Area (LAMBRA),

Targeted Tax Area (TTA), or Manufacturing Enhancement Area (MEA)

A Is this an education IRA within the meaning of R&TC Section 23712? . . . . . . . . . . . . . . .

Yes

No

¼

tax benefits? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

B Is the organization currently under audit? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

H Unrelated Business Activity (UBA) Code

Organizations Taxable as Corporations

¼

1 Unrelated business taxable income from Side 2, Part II, line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Attach

Check

2 Multiply line 1 by the average apportionment percentage ________% from the Schedule R,

or

¼

Apportionment Formula Worksheet, line 6. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Money

¼

3 Enterprise zone, LAMBRA, LARZ, TTA, or Pierce’s disease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Order

¼

4 Net operating loss deduction from form FTB 3805Q. See General Information M . . . . . . . . . . . . . . . . . . .

4

¼

5 Add line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

¼

6 Net unrelated business taxable income. Subtract line 5 from the lesser of line 1 or line 2 . . . . . . . . . . . .

6

¼

7 Tax. ________% x line 6. See General Information J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

¼

8 Tax credits from Schedule B, line 7, or Schedule P (100). See Schedule B instructions . . . . . . . . . . . . . .

8

¼

9 Balance. Subtract line 8 from line 7. If line 8 is greater than line 7, enter -0- . . . . . . . . . . . . . . . . . . . . . .

9

Organizations Taxable as Trusts

¼

10 Unrelated business taxable income from Side 2, Part II, line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Tax

¼

Compu-

11 Enterprise zone, LAMBRA, LARZ, TTA, or Pierce’s disease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

tation

¼

12 Net operating loss deduction from form FTB 3805V. See General Information M . . . . . . . . . . . . . . . . . . . .

12

¼

13 Add line 11 and line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

¼

14 Net unrelated business taxable income. Subtract line 13 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

¼

15 Tax on amount on line 14. See General Information J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

¼

16 Tax credits from Schedule B, line 7, or Schedule P (541). See Schedule B instructions . . . . . . . . . . . . . . .

16

¼

17 Balance. Subtract line 16 from line 15. If line 16 is greater than line 15, enter -0- . . . . . . . . . . . . . . . . . . .

17

18 Tax from line 9 or line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

Total

Tax

19 Alternative minimum tax. See General Information N . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20 Total tax. Add line 18 and line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

21 Overpayment from a prior year allowed as a credit . . . . . . . . . . . . . .

21

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

Payments

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

22 2001 estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

23 Amount paid with automatic extension (FTB 3539) . . . . . . . . . . . . . .

23

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

24 Total payments and credits. Add line 21 through line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Tax due. Subtract line 24 from line 20. Pay entire amount with return. See instructions . . . . . . . . . . . . . .

25

Refund

(Direct

26 Overpayment. Subtract line 20 from line 24. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

Deposit of

27 Enter amount of line 26 to be applied to 2002 estimate tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

Refund) or

Amount

28 Refund. Enter amount of line 26 to be refunded. Subtract line 27 from line 26 . . . . . . . . . . . . . . . . . . . . .

28

Due

¼

a Fill in the account information to have the refund directly deposited. Routing number . . . . .

28a

¼

¼

¼

b Type: Checking

Savings

c Account Number . . . . . . . . . . . . . . . . . . . . . . . . . . .

28c

29 Penalties and interest. See General Information L . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

¼

30

Check if estimate penalty computed using Exception B or C and attach form FTB 5806.

31 Total amount due. Add line 25 and line 29. Pay with return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

31

Person to contact for additional information:

Telephone (

)

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct,

and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign

(

)

Here

Signature of officer

Date

Title

Daytime telephone

Date

Preparer’s SSN/PTIN

Preparer’s

Check if

Paid

signature

self-

FEIN

-

Preparer’s

employed

Firm’s name (or yours, if

Use Only

self-employed) and address

Daytime telephone (

)

10901104

Form 109

2001 Side 1

For Privacy Act Notice, get form FTB 1131.

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5