Form Rpd-41071 - Application For Tax Refund - 2003

ADVERTISEMENT

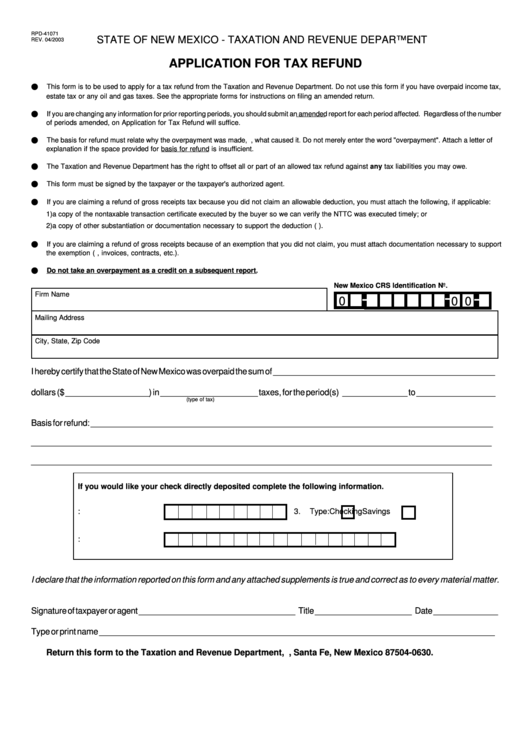

RPD-41071

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV. 04/2003

APPLICATION FOR TAX REFUND

G

This form is to be used to apply for a tax refund from the Taxation and Revenue Department. Do not use this form if you have overpaid income tax,

estate tax or any oil and gas taxes. See the appropriate forms for instructions on filing an amended return.

G

If you are changing any information for prior reporting periods, you should submit an amended report for each period affected. Regardless of the number

of periods amended, on Application for Tax Refund will suffice.

G

The basis for refund must relate why the overpayment was made, i.e., what caused it. Do not merely enter the word "overpayment". Attach a letter of

explanation if the space provided for basis for refund is insufficient.

G

The Taxation and Revenue Department has the right to offset all or part of an allowed tax refund against any tax liabilities you may owe.

G

This form must be signed by the taxpayer or the taxpayer's authorized agent.

G

If you are claiming a refund of gross receipts tax because you did not claim an allowable deduction, you must attach the following, if applicable:

1)

a copy of the nontaxable transaction certificate executed by the buyer so we can verify the NTTC was executed timely; or

2)

a copy of other substantiation or documentation necessary to support the deduction (e.g. farmer or rancher statement).

G

If you are claiming a refund of gross receipts because of an exemption that you did not claim, you must attach documentation necessary to support

the exemption (i.e., invoices, contracts, etc.).

G

Do not take an overpayment as a credit on a subsequent report.

New Mexico CRS Identification No.

-

-

-

Firm Name

0

0 0

Mailing Address

City, State, Zip Code

I hereby certify that the State of New Mexico was overpaid the sum of ________________________________________________

dollars ($ __________________) in _____________________ taxes, for the period(s) ______________ to _________________

(type of tax)

Basis for refund: _______________________________________________________________________________________

____________________________________________________________________________________________________________

_________________________________________________________________________________________________________

If you would like your check directly deposited complete the following information.

1.

Routing Number:

3.

Type:

Checking

Savings

2.

Account Number:

I declare that the information reported on this form and any attached supplements is true and correct as to every material matter.

Signature of taxpayer or agent __________________________________ Title _____________________ Date ______________

Type or print name _____________________________________________________________________________________

Return this form to the Taxation and Revenue Department, P.O. Box 630, Santa Fe, New Mexico 87504-0630.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2