2015 Business License Application Form - Town Of Warsaw, Virginia

ADVERTISEMENT

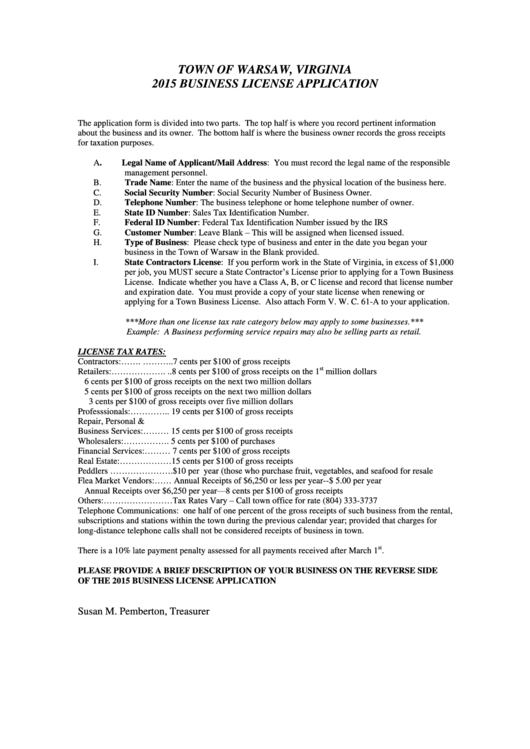

TOWN OF WARSAW, VIRGINIA

2015 BUSINESS LICENSE APPLICATION

The application form is divided into two parts. The top half is where you record pertinent information

about the business and its owner. The bottom half is where the business owner records the gross receipts

for taxation purposes.

A.

Legal Name of Applicant/Mail Address: You must record the legal name of the responsible

management personnel.

B.

Trade Name: Enter the name of the business and the physical location of the business here.

C.

Social Security Number: Social Security Number of Business Owner.

D.

Telephone Number: The business telephone or home telephone number of owner.

E.

State ID Number:

Sales Tax Identification Number.

F.

Federal ID Number: Federal Tax Identification Number issued by the IRS

Customer Number: Leave Blank – This will be assigned when licensed issued.

G.

H.

Type of Business: Please check type of business and enter in the date you began your

business in the Town of Warsaw in the Blank provided.

I.

State Contractors License: If you perform work in the State of Virginia, in excess of $1,000

per job, you MUST secure a State Contractor’s License prior to applying for a Town Business

License. Indicate whether you have a Class A, B, or C license and record that license number

and expiration date. You must provide a copy of your state license when renewing or

applying for a Town Business License. Also attach Form V. W. C. 61-A to your application.

***More than one license tax rate category below may apply to some businesses.***

Example: A Business performing service repairs may also be selling parts as retail.

LICENSE TAX RATES:

Contractors:……. ………..7 cents per $100 of gross receipts

Retailers:………………. ..8 cents per $100 of gross receipts on the 1

st

million dollars

6 cents per $100 of gross receipts on the next two million dollars

5 cents per $100 of gross receipts on the next two million dollars

3 cents per $100 of gross receipts over five million dollars

Professsionals:………….. 19 cents per $100 of gross receipts

Repair, Personal &

Business Services:……… 15 cents per $100 of gross receipts

Wholesalers:……………. 5 cents per $100 of purchases

Financial Services:……… 7 cents per $100 of gross receipts

Real Estate:………………15 cents per $100 of gross receipts

Peddlers ………………….$10 per year (those who purchase fruit, vegetables, and seafood for resale

Flea Market Vendors:…… Annual Receipts of $6,250 or less per year--$ 5.00 per year

Annual Receipts over $6,250 per year—8 cents per $100 of gross receipts

Others:……………………Tax Rates Vary – Call town office for rate (804) 333-3737

Telephone Communications: one half of one percent of the gross receipts of such business from the rental,

subscriptions and stations within the town during the previous calendar year; provided that charges for

long-distance telephone calls shall not be considered receipts of business in town.

st

There is a 10% late payment penalty assessed for all payments received after March 1

.

PLEASE PROVIDE A BRIEF DESCRIPTION OF YOUR BUSINESS ON THE REVERSE SIDE

OF THE 2015 BUSINESS LICENSE APPLICATION

Susan M. Pemberton, Treasurer

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2