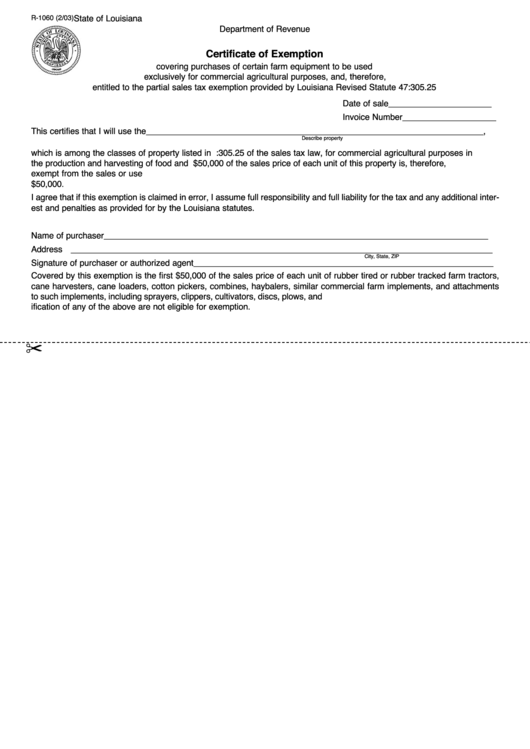

R-1060 (2/03)

State of Louisiana

Department of Revenue

Certificate of Exemption

covering purchases of certain farm equipment to be used

exclusively for commercial agricultural purposes, and, therefore,

entitled to the partial sales tax exemption provided by Louisiana Revised Statute 47:305.25

Date of sale ______________________

Invoice Number ____________________

This certifies that I will use the ________________________________________________________________________,

Describe property

which is among the classes of property listed in R.S. 47:305.25 of the sales tax law, for commercial agricultural purposes in

the production and harvesting of food and fiber. The first $50,000 of the sales price of each unit of this property is, therefore,

exempt from the sales or use tax. The tax is payable on the portion of the sales price or cost price of each unit in excess of

$50,000.

I agree that if this exemption is claimed in error, I assume full responsibility and full liability for the tax and any additional inter-

est and penalties as provided for by the Louisiana statutes.

Name of purchaser __________________________________________________________________________________

Address __________________________________________________________________________________________

City, State, ZIP

Signature of purchaser or authorized agent________________________________________________________________

Covered by this exemption is the first $50,000 of the sales price of each unit of rubber tired or rubber tracked farm tractors,

cane harvesters, cane loaders, cotton pickers, combines, haybalers, similar commercial farm implements, and attachments

to such implements, including sprayers, clippers, cultivators, discs, plows, and spreaders. The parts used in the repair or mod-

ification of any of the above are not eligible for exemption.

✂

1

1