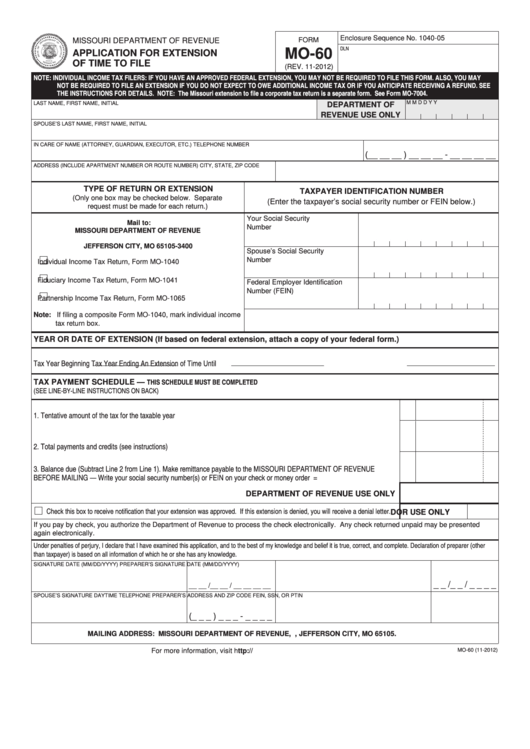

Reset Form

Print Form

Enclosure Sequence No. 1040-05

MISSOURI DEPARTMENT OF REVENUE

FORM

DLN

MO-60

APPLICATION FOR EXTENSION

OF TIME TO FILE

(REV. 11-2012)

NOTE: INDIVIDUAL INCOME TAX FILERS: IF YOU HAVE AN APPROVED FEDERAL EXTENSION, YOU MAY NOT BE REQUIRED TO FILE THIS FORM. ALSO, YOU MAY

NOT BE REQUIRED TO FILE AN EXTENSION IF YOU DO NOT EXPECT TO OWE ADDITIONAL INCOME TAX OR IF YOU ANTICIPATE RECEIVING A REFUND. SEE

THE INSTRUCTIONS FOR DETAILS. NOTE: The Missouri extension to file a corporate tax return is a separate form. See Form MO-7004.

M

M

D

D

Y

Y

LAST NAME, FIRST NAME, INITIAL

DEPARTMENT OF

REVENUE USE ONLY

SPOUSE’S LAST NAME, FIRST NAME, INITIAL

IN CARE OF NAME (ATTORNEY, GUARDIAN, EXECUTOR, ETC.)

TELEPHONE NUMBER

(__ __ __ ) __ __ __ - __ __ __ __

ADDRESS (INCLUDE APARTMENT NUMBER OR ROUTE NUMBER)

CITY, STATE, ZIP CODE

TYPE OF RETURN OR EXTENSION

TAXPAYER IDENTIFICATION NUMBER

(Only one box may be checked below. Separate

(Enter the taxpayer’s social security number or FEIN below.)

request must be made for each return.)

Your Social Security

Mail to:

Number

MISSOURI DEPARTMENT OF REVENUE

P.O. BOX 3400

JEFFERSON CITY, MO 65105-3400

Spouse’s Social Security

Number

Individual Income Tax Return, Form MO-1040

Fiduciary Income Tax Return, Form MO-1041

Federal Employer Identification

Number (FEIN)

Partnership Income Tax Return, Form MO-1065

Note: If filing a composite Form MO-1040, mark individual income

tax return box.

YEAR OR DATE OF EXTENSION (If based on federal extension, attach a copy of your federal form.)

Tax Year Beginning

Tax Year Ending

An Extension of Time Until

THIS SCHEDULE MUST BE COMPLETED

TAX PAYMENT SCHEDULE —

(SEE LINE-BY-LINE INSTRUCTIONS ON BACK)

1. Tentative amount of the tax for the taxable year ...........................................................................................................................

1

2. Total payments and credits (see instructions) ................................................................................................................................

2

3. Balance due (Subtract Line 2 from Line 1). Make remittance payable to the MISSOURI DEPARTMENT OF REVENUE

BEFORE MAILING — Write your social security number(s) or FEIN on your check or money order ...........................................

3

=

DEPARTMENT OF REVENUE USE ONLY

Check this box to receive notification that your extension was approved. If this extension is denied, you will receive a denial letter.

DOR USE ONLY

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented

again electronically.

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief it is true, correct, and complete. Declaration of preparer (other

than taxpayer) is based on all information of which he or she has any knowledge.

SIGNATURE

DATE (MM/DD/YYYY)

PREPARER’S SIGNATURE

DATE (MM/DD/YYYY)

_ _ /_ _ / _ _ _ _

__ __ /__ __ / __ __ __ __

SPOUSE’S SIGNATURE

DAYTIME TELEPHONE

PREPARER’S ADDRESS AND ZIP CODE

FEIN, SSN, OR PTIN

(_ _ _ ) _ _ _ - _ _ _ _

MAILING ADDRESS: MISSOURI DEPARTMENT OF REVENUE, P.O. BOX 3400, JEFFERSON CITY, MO 65105.

For more information, visit

MO-60 (11-2012)

1

1