CONTRIBUTION PLAN DESCRIPTIONS

There are two contribution plans available to certain members of PERS; the

employee/employer contribution plan and the employer-pay contribution plan (EPC).

The employee/employer contribution plan provides that members will have a retirement

contribution deducted from their gross salary, as shown below, and that contributions will be

maintained on account at PERS. In the event that the member terminates employment

covered by PERS, those contributions will be available for refund to the member.

The advantage of the employee/employer contribution plan is that, even though the take-

home pay (after income tax withholding) is slightly less, in the event of termination, the

employee contributions would be refundable without interest.

The employer-pay contribution plan has the gross salary adjusted downward, as shown

below, but does not have a retirement contribution deducted. The employer pays the full

retirement contribution based on the adjusted gross salary. In the event of termination, the

employee would not be eligible for a refund.

For members who intend to remain with PERS until they are eligible for benefits, the cost of

their retirement will be less and the amount of the take-home pay will be slightly greater (see

example below). The disadvantage is that the contributions paid on the employee’s behalf are

not refundable in the event of termination and the gross salary is less. This may adversely

affect credit applications.

If a member chooses the employee/employer contribution plan, he/she can elect, at a future

date, to contribute under the employer-pay contribution plan. Choice of the employer-pay

contribution plan is a one-time election, which cannot be reversed.

The amount of any future retirement benefits will be exactly the same under either

contribution plan.

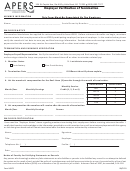

Example Contribution Plan Comparison

Employee/

Employer

Employer

Pay

1. Gross Salary

$2,500.00

$2,500.00

2. Reduction for employer pay

n/a

$307.02

3. Adjusted gross salary

$2,500.00

$2,192.98

4. Employee retirement contribution

$362.50

n/a

5. 15% Income Tax Withholding

$375.00

$ 328.94

6. Take-home pay

$1,762.50

$1,864.04

Estimated difference in monthly take-home pay: $101.54

If you have any questions or desire any further explanation, please contact PERS toll free

1-866-473-7768 or direct in Carson City (775) 687-4200 or in Las Vegas (702) 486-3900.

1

1 2

2