Liquor License Renewal Notice/inventory/property Tax Certification Form

ADVERTISEMENT

RDS

Attn: City of Sulphur Liquor License Renewal

9618 Jefferson Highway, Suite D #334

Baton Rouge, LA 70809

Phone: 800-556-7274

Fax: 844-528-6529

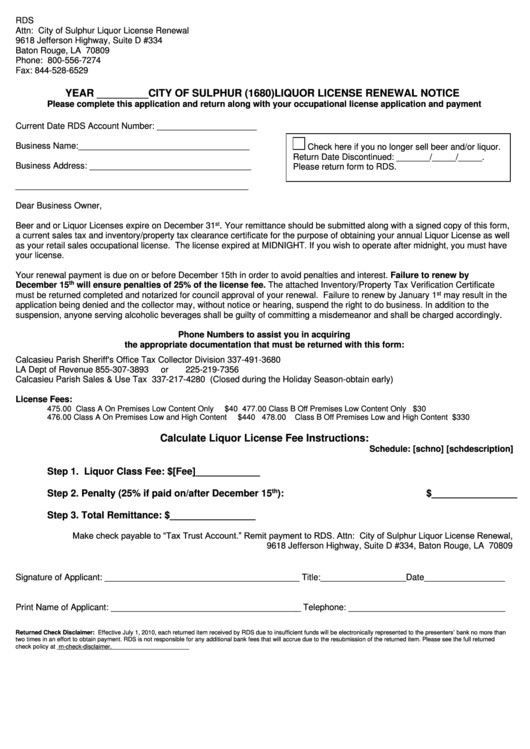

YEAR _________CITY OF SULPHUR (1680) LIQUOR LICENSE RENEWAL NOTICE

Please complete this application and return along with your occupational license application and payment

Current Date

RDS Account Number: _____________________

Business Name:____________________________________

Check here if you no longer sell beer and/or liquor.

Return Date Discontinued: _______/_____/_____.

Business Address: __________________________________

Please return form to RDS.

_________________________________________________

Dear Business Owner,

st

Beer and or Liquor Licenses expire on December 31

. Your remittance should be submitted along with a signed copy of this form,

a current sales tax and inventory/property tax clearance certificate for the purpose of obtaining your annual Liquor License as well

as your retail sales occupational license. The license expired at MIDNIGHT. If you wish to operate after midnight, you must have

your license.

Your renewal payment is due on or before December 15th in order to avoid penalties and interest. Failure to renew by

th

December 15

will ensure penalties of 25% of the license fee. The attached Inventory/Property Tax Verification Certificate

st

must be returned completed and notarized for council approval of your renewal. Failure to renew by January 1

may result in the

application being denied and the collector may, without notice or hearing, suspend the right to do business. In addition to the

suspension, anyone serving alcoholic beverages shall be guilty of committing a misdemeanor and shall be charged accordingly.

Phone Numbers to assist you in acquiring

the appropriate documentation that must be returned with this form:

Calcasieu Parish Sheriff's Office Tax Collector Division

337-491-3680

LA Dept of Revenue

855-307-3893

or

225-219-7356

Calcasieu Parish Sales & Use Tax

337-217-4280

(Closed during the Holiday Season-obtain early)

License Fees:

475.00 Class A On Premises Low Content Only

$40

477.00

Class B Off Premises Low Content Only

$30

476.00 Class A On Premises Low and High Content

$440

478.00

Class B Off Premises Low and High Content

$330

Calculate Liquor License Fee Instructions:

Schedule: [schno] [schdescription]

Step 1. Liquor Class Fee:

$[Fee]____________

th

Step 2. Penalty (25% if paid on/after December 15

):

$________________

Step 3. Total Remittance:

$________________

Make check payable to “Tax Trust Account.” Remit payment to RDS. Attn: City of Sulphur Liquor License Renewal,

9618 Jefferson Highway, Suite D #334, Baton Rouge, LA 70809

Signature of Applicant: _________________________________________ Title:__________________Date_________________

Print Name of Applicant: ________________________________________ Telephone: _________________________________

Returned Check Disclaimer: Effective July 1, 2010, each returned item received by RDS due to insufficient funds will be electronically represented to the presenters’ bank no more than

two times in an effort to obtain payment. RDS is not responsible for any additional bank fees that will accrue due to the resubmission of the returned item. Please see the full returned

check policy at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2