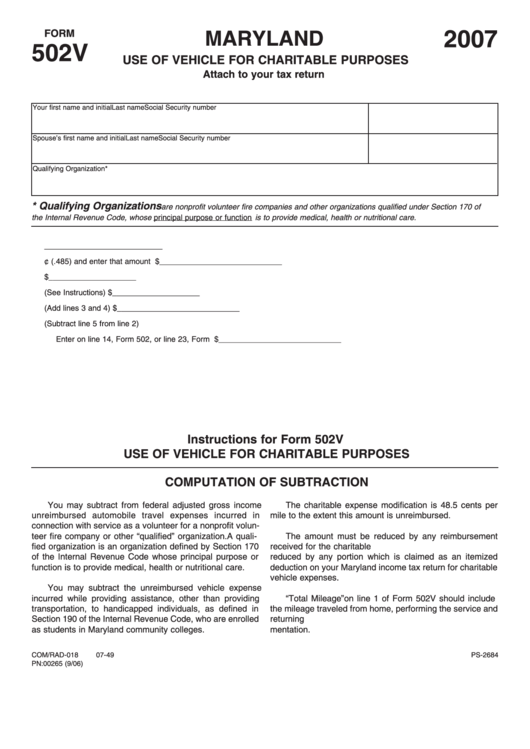

FORM

2007

MARYLAND

502V

USE OF VEHICLE FOR CHARITABLE PURPOSES

Attach to your tax return

Your first name and initial

Last name

Social Security number

Spouse’s first name and initial

Last name

Social Security number

Qualifying Organization*

* Qualifying Organizations

are nonprofit volunteer fire companies and other organizations qualified under Section 170 of

the Internal Revenue Code, whose principal purpose or function is to provide medical, health or nutritional care.

1. Total mileage incurred in providing qualifying services ............................................................ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2. Multiply line 1 by 48.5¢ (.485) and enter that amount here ......................................................

$_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

3. Reimbursement received for mileage on line 1 ........................................................................ $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4. Amount included as an itemized deduction on your Maryland return (See Instructions) ........ $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

5. Total Maryland deductions from mileage allowance (Add lines 3 and 4)..................................

$_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

6. Modification for charitable vehicle expenses (Subtract line 5 from line 2)

Enter on line 14, Form 502, or line 23, Form 505 ....................................................................

$_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Instructions for Form 502V

USE OF VEHICLE FOR CHARITABLE PURPOSES

COMPUTATION OF SUBTRACTION

You may subtract from federal adjusted gross income

The charitable expense modification is 48.5 cents per

unreimbursed automobile travel expenses incurred in

mile to the extent this amount is unreimbursed.

connection with service as a volunteer for a nonprofit volun-

teer fire company or other “qualified” organization. A quali-

The amount must be reduced by any reimbursement

fied organization is an organization defined by Section 170

received for the charitable travel. The amount must also be

of the Internal Revenue Code whose principal purpose or

reduced by any portion which is claimed as an itemized

function is to provide medical, health or nutritional care.

deduction on your Maryland income tax return for charitable

vehicle expenses.

You may subtract the unreimbursed vehicle expense

incurred while providing assistance, other than providing

“Total Mileage” on line 1 of Form 502V should include

transportation, to handicapped individuals, as defined in

the mileage traveled from home, performing the service and

Section 190 of the Internal Revenue Code, who are enrolled

returning home. You should maintain the appropriate docu-

as students in Maryland community colleges.

mentation.

COM/RAD-018

07-49

PS-2684

PN: 00265 (9/06)

1

1